Creating or Auditing your Client’s Business Plan

Business Advisor Series Article 6

Thanks for the terrific feedback about the recent webinar about Business Plans. If there’s confusion and misconception about Strategic Planning (see article), there’s maybe more about the Business Plan. Is a business model a plan? How is a business plan different from a strategic plan? Isn’t a strategic plan a business plan?

This article discusses the Business Advisor as Architect, helping to create a business plan or auditing an existing plan. Later, after client acceptance, you can move into a General Contractor role, shifting the business plan into gear.

This article picks up the case of a Business Advisor working with her client Toplift Services LLC, a Professional Services provider. The service being delivered is an audit of the firm's business model, and the plan to convert this model into revenues. See also: Business Case for Implementing CoreValue

Let's start by straightening out some terminology, bringing clarity about who's on first.

The Business Model is how a company makes money. This is where clients can get into trouble: perhaps their business model has not kept up with growth, or is impeding growth.

The Business Plan details the people and actions needed to execute the business model in furtherance of the mission. Here's that pesky Mission again… it’s the 'there' there.

A Strategic Plan can change the business model and/or plan. It can also be a Russian Doll: a plan within the existing Business Model and Plan, for example a plan to “increase revenues X% by Y date.”

Note: a Business Plan doesn’t need a date, it rolls on towards the Mission… but a Strategic Plan must be accountable to (1) an event or condition, (2) by a date certain.

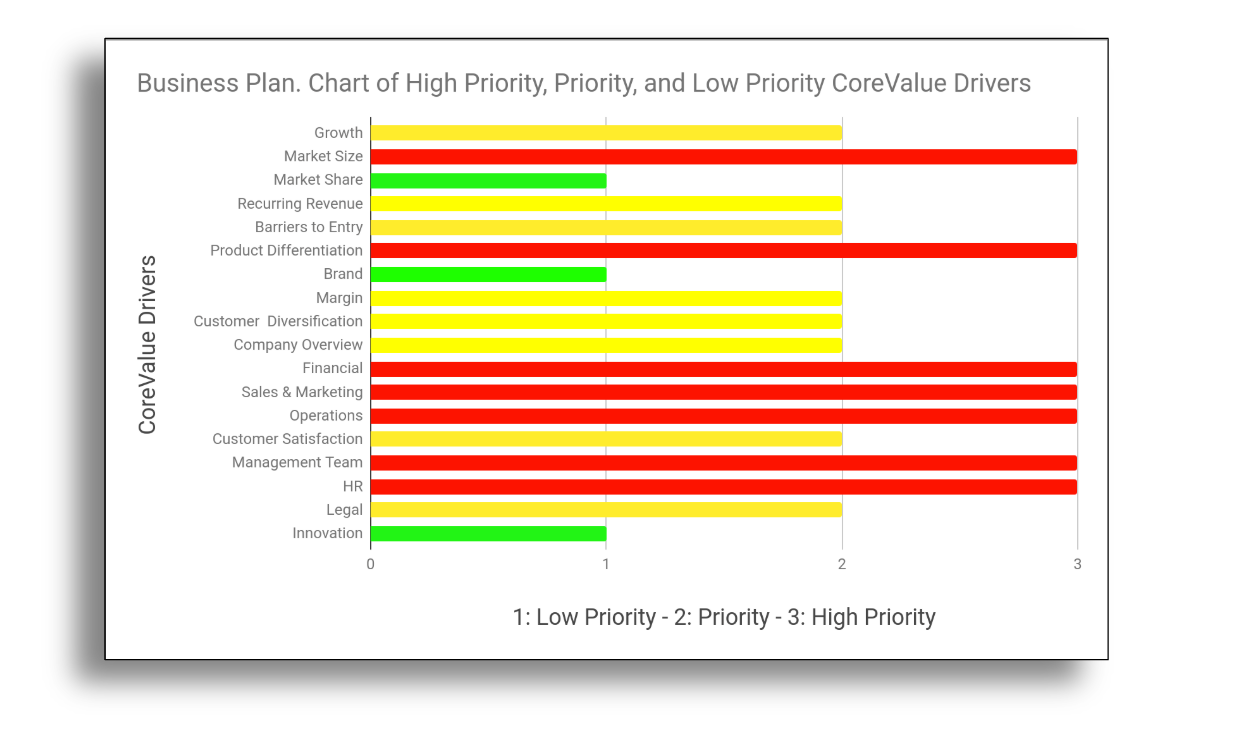

CoreValue’s patented methodology1 is 18 CoreValue Drivers which make up the totality of a company’s operations. CoreValue's technology measures the strength of the Value Drivers, calculates a score, and then applies the aggregate score to calculate equity value. The high priority Value Drivers when auditing or creating a Business Plan are:

- Mission: Company Overview --Why we Exist

- Niche: Potential Market --Who we Serve

- Product Differentiation --What we Sell

- Marketing, Sales --How we Market and Sell

- Operations --How we Deliver

- Senior Management --How we Manage

- Human Resources --How we get People

- Finance --How we Measure

Figure 1. Priority of Value Drivers in Business Plan

The Mission Statement is where the Business Advisor starts the process of building or auditing a client’s Business Plan. The Mission may need updating once the rest of the plan’s elements are analyzed and understood.

Toplift Services LLC’s Mission is to “Deliver best-in-class expertise to qualified private companies, driving growth of client revenues and shareholder value.” This mission statement also refers to the niche “qualified private companies.” Strong.

Next, the client's business model should be confirmed: companies have to evolve with their markets. For example, Toplift Services LLC’s model started as “sell the expertise of our employees on an hourly basis to privately-held middle market companies.” In response to the firm's goals and to better serve their clients, the model is evolving from “hourly” to “value” billing.

Niche: Who we Serve. How well does Toplift Services LLC understand their Niche? Their Operational Strength and Value Report has the answer. The business plan aims to implement best practices.

Figure 2. Value Driver: Potential Market; Sub-Driver: Niche Clarity

Action step in a strategic plan would be to increase this score.

Product Differentiation: What We Sell. Is you client’s plan to sell a commodity? Probably not. Or would the company be more successful selling a product or service with unique characteristics?

Figure 3. Value Driver: Product Differentiation; Sub-Driver: Proof of Differentiation

Toplift scores 0; updating their Business Plan will include making this Value Driver strong. If the client wants to grow revenues and shareholder value (that's strategic planning...), Toplift’s advisor can add changing the business model from hourly to value-based, plus implementing processes to uncover and communicate Toplift’s value to their clients. The sub-goal here is to increase net margin.

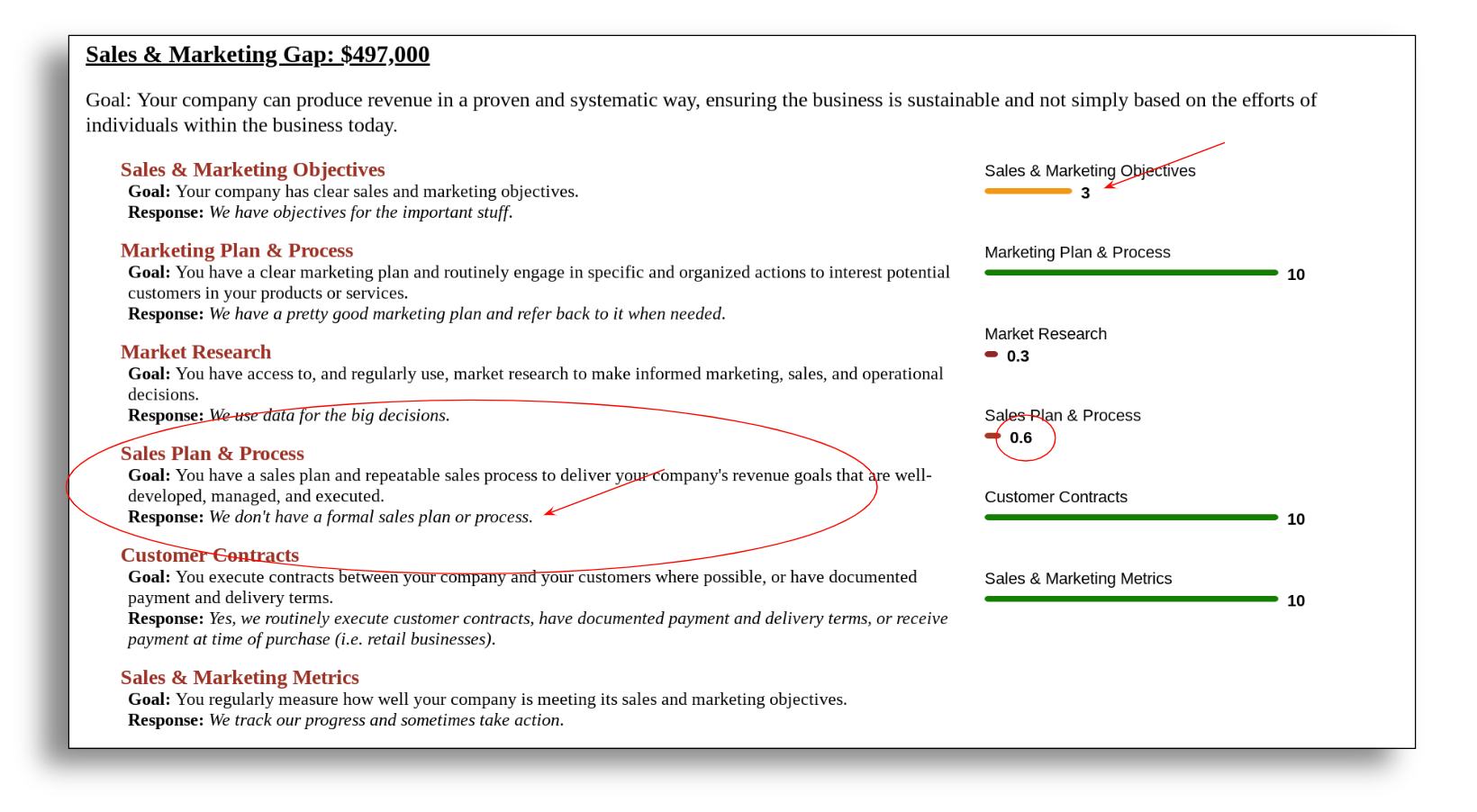

Sales & Marketing: How We Market and Sell. Now that there’s clarity on the Mission, Niche, and Product, the business plan focuses on generating revenues. This starts with marketing, or attracting strangers who would benefit from being Toplift’s customers. Following marketing is sales: converting qualified strangers into paying clients. Like many professional services firms, Toplift has a strong marketing process (Director of Marketing) delivering potential clients (leads)... into a weak sales process.

Figure 4. Value Driver: Sales & Marketing; Sub-Driver Sales Plan & Process

The firm is doing a great job with marketing… but marketing is disconnected from sales. The Partners are not accountable to Marketing for the leads generated. It’s as if there are two separate plans: (1) the firm's marketing plan, and (2) the partners, who rely on referrals, repeat business and working harder to meet their individual contributions to the firm’s budget.

Partners are not accountable to Marketing for the leads generated. It’s as if there are two separate plans: (1) the firm's marketing plan, and (2) the partners, who rely on referrals, repeat business and working harder to meet their individual contributions to the firm’s budget.

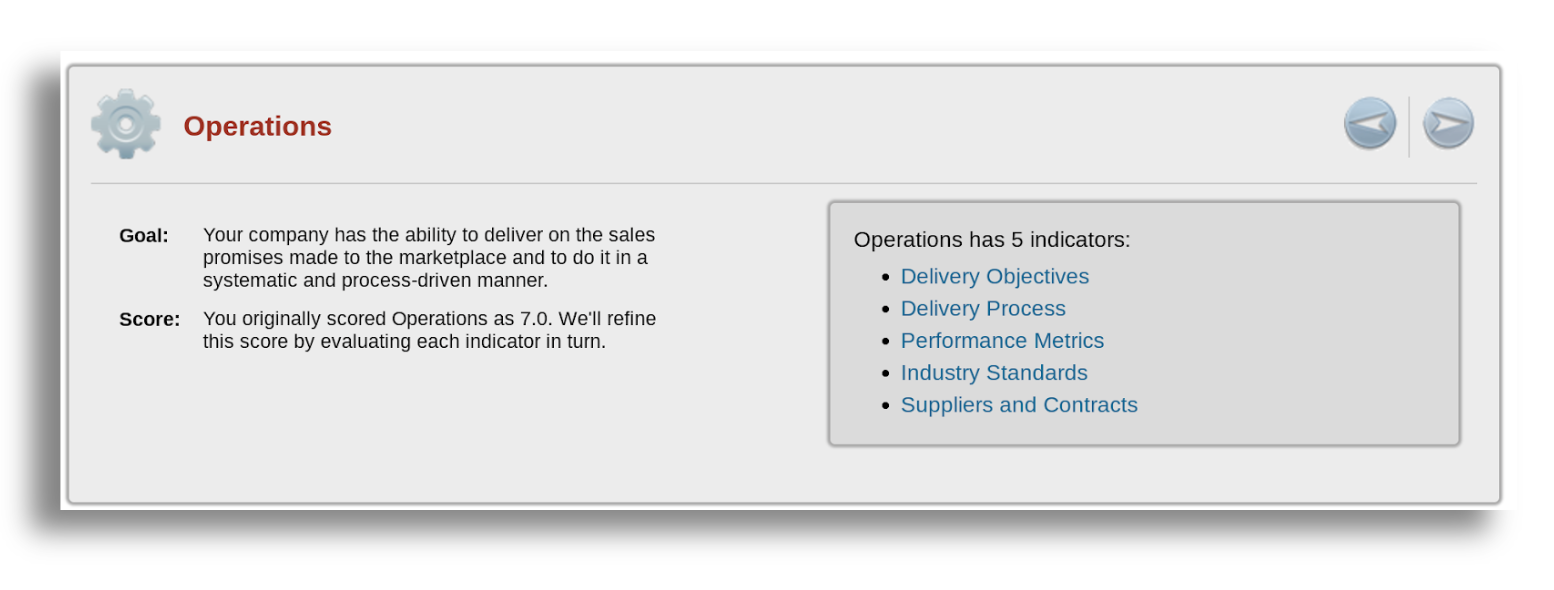

Operations: How we Deliver. Does the company have a proven and systematic, documented plan to deliver on the promises made to the market by sales? (Strategic Planning opportunity: when the improved business plan is executed and sales gains traction, will the firm still be able to deliver?)

Figure 5. Value Driver: Operations

This is the fulcrum of your client’s Business Plan. If auditing a plan, measure strength; the client should be planning to support both current sales and growth.

This is the fulcrum of your client’s Business Plan. If auditing a plan, measure strength; the client should be planning to support both current sales and growth.

Senior Management: How we Manage. Right people, doing the right things right. The business plan includes an org chart, job descriptions, and accountability. If you are creating a business plan, see Whickman’s Traction3 and Harnish’s Scaling Up4 for guidance in these areas. If you are auditing a plan, refer to the CoreValue Operational Strength and Value Report; the cited resources are terrific guidance as well.

Figure 6. Value Driver: Senior Management

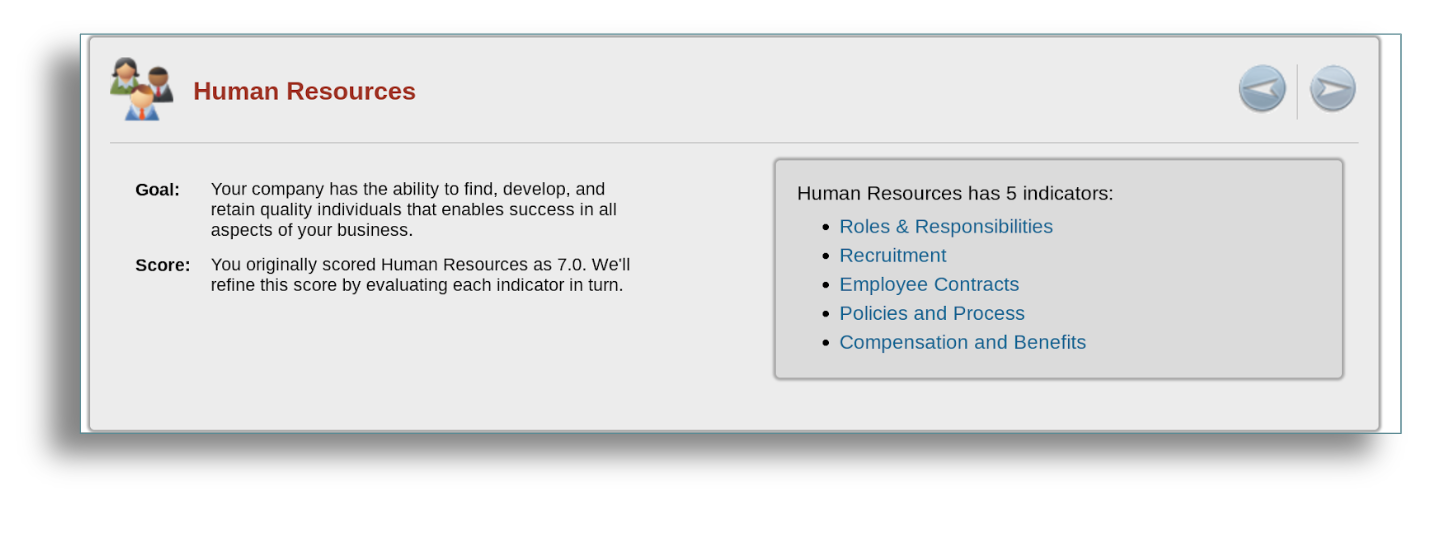

Human Resources: How we get People. Hiring a team with the proper skills and core values, who’s professional capabilities and ethics align with the company’s Mission does not happen by chance. It happens by plan. The business plan describes how the company will successfully hire the right people.

Figure 7. Value Driver: Human Resources

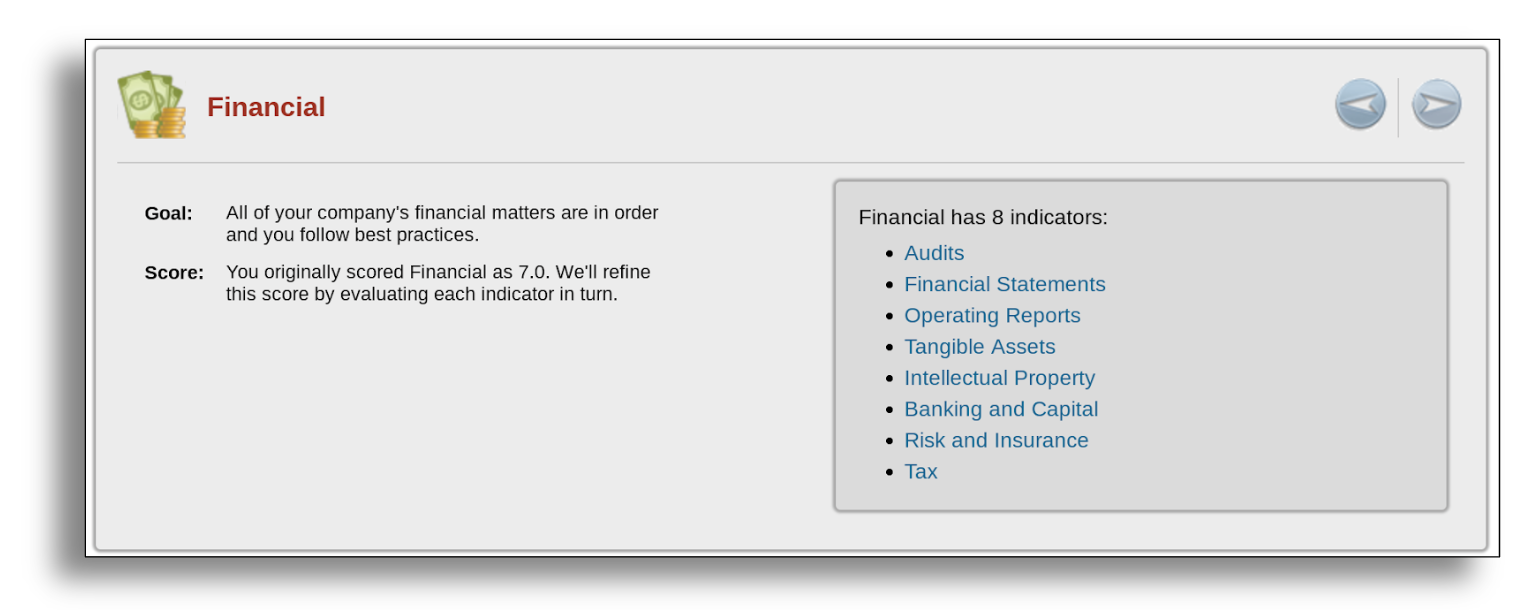

Finance: How we Measure. The metrics for measuring a successful business plan are Revenues and Shareholder Value. An early business plan may not require much sophistication in this area, but as a company matures you’ll need to audit this function to confirm Finance is as strong as the system it supports and measures.

Figure 8. Value Driver: Financial

Recap:

- To create a business plan, start with the mission and business model

- Once you have these nailed down, list best practices for each of the business plan’s areas

- If you are creating a business plan, use the best practices to describe the goal for each area

- If you are auditing an existing plan, analyze the strength of the the client’s Value Drivers that are High Priority for Business Planning

- Note that this analysis may cause a change in the business model and/or mission

You can learn more in the free webinars, check them out here.

We'd love to know what you think: comment here, follow us on LinkedIn, or send an email to blog@corevalueforadvisors.com

[1] CoreValue® US Patent 9,607,274

[2] See Million Dollar Consulting Proposals p 17. Weiss, Alan. Million Dollar Consulting Proposals: How to Write a Proposal That's Accepted Every Time. John Wiley & Sons, 2012. Available on Amazon.

[3] Wickman, Gino. Traction. Benbella Books, 2012.

[4] Harnish, Verne. Scaling up: How a Few Companies Make It ... and Why the Rest Don't. Gazelles Inc., 2015.