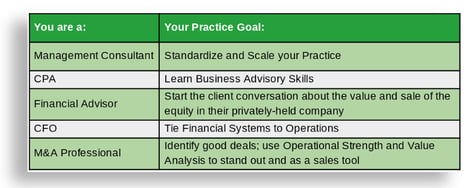

Strategic Planning: You Can Do This, We Can Help

Business Advisor Series Article 5

Strategic planning is not voodoo. It is not a process chiseled into rock for all to obey. And the strategic planning practiced by Bain, BCG, and Accenture is, well… who cares: they focus almost solely on public multinationals, not on the middle-market heart of US businesses that drive our economy. Let’s talk about strategic planning for private companies with revenues between $2.5MM and $50MM: let’s talk about your clients.

A strategic plan describes “how” your client will reach their “why.”

Previous articles have pulled from CoreValue’s data on the operational analysis of over 10,000 client companies. Let’s approach “Strategic Planning” a bit differently: we’ll unpack an HBR article on strategy. Please read Graham Kenney’s terrific HBR article Your Strategic Plans Probably Aren’t Strategic, or Even Plans.1

Now that we are all singing from the same sheet, let’s discuss how you can deliver a vital, valuable service to your client: auditing or creating the strategic plan that will help them reach their objectives. The Strategic Plan is analogous to a blueprint, and the Business Advisor is the architect.2 Converting the blueprint into reality is covered elsewhere; for now we’re talking about planning.

Does this paragraph from the HBR piece sound like your clients? “Unfortunately, while C-suite executives talk “strategy,” they’re often confused about what it means. Why this confusion? The problem starts with the word itself — a scarily misunderstood concept in management and board circles. The most basic mix-up is between “objective,” “strategy,” and “action.” (I see this frequently in published strategic plans as well.) Grasp this, I tell my audience, and your day will be well spent." An “objective” is something you’re trying to achieve — a marker of the success of the organization. At the other end of the spectrum is “action.” This occurs at the individual level — a level that managers are presented with day after day. So naturally when [managers] think “strategy” they focus on what they do. But this isn’t strategy either. “Strategy” takes place between [objective and action] at the organization level and managers can’t “feel” that in the same way. It’s abstract. CEOs have an advantage here because only they have a total view of the organization.” (Emphasis added.)

Business Advisors are peers with the CEO, helping the CEO execute her fundamental role of maximizing shareholder value (see Business Advisor Series Article 1). Helping the CEO gain the “total view of the organization” referenced by HBR is arguably your most important deliverable.3

Here’s a great example used in the Business Advisor Training classes to differentiate objectives, strategy and action:

- Objective: End the War in Europe

- Strategic Plan: Invade Europe through Normandy, attack across France, Belgium and Germany, and occupy Berlin

- Action (tactical execution): load soldiers into Higgins Boats and Aircraft, cross the Channel, and put boots on French soil

Using the insights from the HBR article, let’s walk through designing or auditing a strategic plan. The case reviews a privately held services firm Toplift Services LLC, whose objective is to drive growth. #drivegrowth

There is no plan without an objective. Therefore the first question you’ll need to answer in order to prepare a Strategic Plan: “Does your client have a clearly defined objective?” Plus,

- Is it realistic in size and time frame? If not, work with the client to re-frame. An operational analysis provides guidance

- If the client does not have a Mission, with near- and medium-term Objectives, check out the Traction VT/O and the Scaling Up One Page Strategic Plan

Returning to the HBR article, “If you take a helicopter view of the process I’ve outlined, you can see that it involves system design. Each key stakeholder group is taken in turn to work out what an organization wants from it (an objective) and what the key stakeholder wants from it (strategic factors) [...] The strategic planning team must then decide on the organization’s position on these factors (strategy). This will be conditioned, of course, by customer research. Having done this, key stakeholder by key stakeholder, the next step is to ensure congruence — system design. (Emphasis added.)

Translating, the company objective is comprised of sub-objectives assigned to relevant stakeholders. Identifying these sub-objectives, and designing a system to reach them is strategic planning. The system of course does not exist in a vacuum:

- What is the landscape in which the company exists?

- How well can the company, in its current state, navigate this landscape?

- These are strategic factors, to be factored into your client's strategic plan.

It follows that once the client’s objective is confirmed, the Business Advisor must gain an understanding of the competitive landscape, existing operational processes, and relevant stakeholders (cumulatively, Strategic Factors). This understanding is gained by performing a detailed analysis. In the CoreValue system, Strategic Factors are called Value Drivers. By analyzing the strength of the Value Drivers, the Business Advisor establishes a baseline from which to plan. For example, if Company X has strong Financial Systems, the plan does not need to include “Improve Financial Systems” --makes sense, right? Let’s walk through what this looks like in practice.

Client: Toplift Services PLLC4

Chart 1: Summary Information on Toplift Services PLLC, CoreValue Business Rating 54 of 100

For this case, the client has declared a growth objective of “Achieve Net Profit (annualized) of $2MM within 18 Months.” The Advisor discussed M&A with the CEO and it is not an option due to (1) tight time frame, and (2) direction from her Board. Armed with this clearly defined Objective, the Business Advisor took two steps to create the clarity needed for planning.

- Analyzing the client’s ability to generate the excess cash flow needed to reach to objective5 (assuming here that cash is sufficient)

- Analyzing the client’s operations. The health of the Value Drivers (Strategic Factors) drives the plan. The analysis identifies strong and weak Value Drivers

- To reach the Objective, the Value Drivers are prioritized: 1, low priority; 2, priority; and 3, high priority

- Combining the operational analysis with the priority list, we start adding Value Drivers to the Strategic Plan:

- Weak ‘High Priority’ Factors: add to strategic plan as “needing improvement,” including a list of tasks to be accomplished to create strength

- Strong ‘High Priority’ Factors: add to strategic plan as “monitor.” Strong drivers can become stressed when the tactical load increases. For example, increasing sales and marketing performance can stress operations, which must deliver increased volume

Reviewing Toplift’s fundamentals, we see GR of $10MM, revenue per employee at $200M, and 5% net margin. Within 18 months, can the client:

- Option 1: Drive net margin from 5% to 20%?

- Well-run service firms generate net margin of approximately 20%. The Business Advisor and CEO decide on 15% as a sub-objective.

- Option 2: Grow GR from $10MM to $40MM?

- Robust growth for an established firm is 20% per annum; again the Advisor and CEO agree 20% growth is an aggressive-yet-attainable sub-objective.

The Strategic Plan will include both these sub-objectives. If successfully implemented these will result in a 'win' for both Client and Advisor, and Toplift’s Strategic Objective will be reached.

Given the 18 month time frame, execution of the plan must align all of the Strategic Factors required to jump out of the gate winning new clients for existing services at deeper margins. The best plans are often the most simple. Next question: what drivers of the client’s operations need improvement to hit the two sub-objectives ‘new clients’ and ‘deeper margins?’ The answers come from the Business Advisor’s Deep-Dive Analysis of Toplift’s operations.

Chart 2: CoreValue Rating (including Impact on Shareholder Value)

Most of Toplift's operational weakness is in Market Strategic Factors (Value Drivers).

Chart 3: Toplift Services LLC Operational Analysis; arrows designate High Priority Drivers

Toplift’s objective is net revenues (not merely top-line growth). Article 4 discussed prioritizing value drivers for growth. Since the objective is margin-driven, the Margin Advantage analysis has been added. Likewise for strong Financial Systems. These may not rise to High Priority when simply growing top line revenues, but are critical in driving net income. One can see that changing the goal from Gross to Net revenues increases the complexity of the engagement from 8 High Priority Value Drivers to 10. Here are the additional two value drivers:

- Margin Advantage: You have projections of your company's future margin advantage, and can defend these projections. Reader: think about what work goes into meeting this last “defend” clause.

- Financial: All of your company's financial matters are in order and you follow best practices, and specifically CoreValue Driver 11:2 Financial Statements and 11:3 Operating Reports.

Chart of Priorities for Strategic Factors, aka CoreValue Drivers

One can begin to see the bones of the plan taking shape. To illustrate we will focus on three High Priority Strategic Factors:

- Sales & Marketing: this improves the sub-objective to increase sales (gross revenues)

- Senior Management (plus Human Resources): the plan will specify at new management role, new hires, training, and a comp plan driving desired behaviors

- Product Differentiation: the sub-objective ‘higher margins’ requires updated positioning and product design

Sales & Marketing. High Priority.

Like many professional services companies, the client exhibits strong performance in defining sales and marketing objectives, marketing process (with these firms Marketing is often managed by a dedicated professional) and Customer Contracts. However, they are failing in Sales Process and Objectives, rated 3 of 10. Add to the Strategic Plan: creating, deploying and managing a sales (revenue generation) process.

Providing detail to this aspect of the strategic plan, the Business Advisor pulls Suggested Tasks from the Unlock Executable Growth Plan:

Suggested Tasks: Sales Plan & Process6

- Create a well-documented sales plan

- Create a sales process that is documented, measurable, and monitored

- Create clear communication and understanding of the sales plan within the company

- Create a sales compensation plan that is motivating, easy to understand, and doesn’t change frequently

- Implement a monitoring system (CRM) that is used by the sales team and management

Having a new sales process is half the battle: the plan must include details for implementing the new sales process. Further, sales plans may be measured using activity and revenue, but the fuel is compensation. These are addressed in the Senior Management and Human Resources drivers.

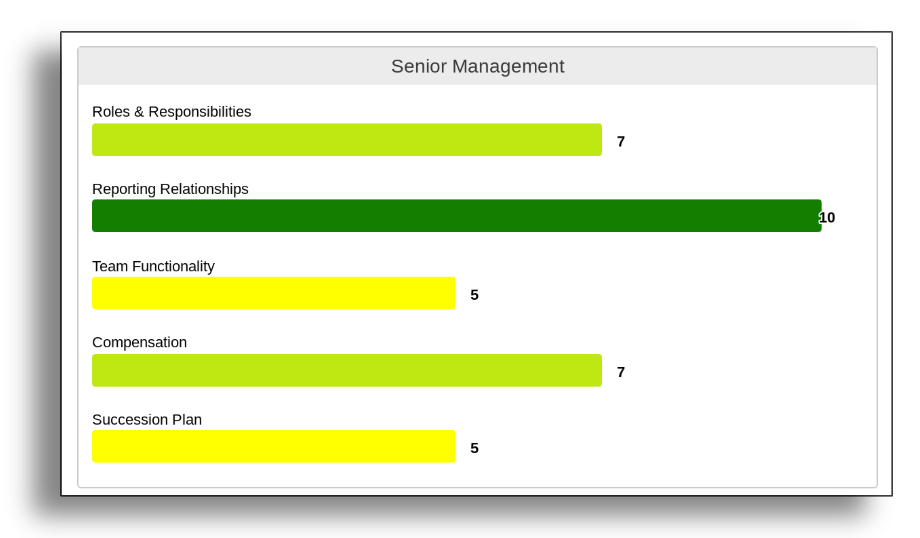

Senior Management. High Priority.

Chart of Senior Management, Toplift rates 6.2 of 10

There are 2 sub-drivers in Senior Management needing improvement. First, two functions are failing the organization --without even getting into Company Culture. Toplift’s Senior Team does not have an effective Chief Revenue Officer or Chief Financial Officer. The CRO role may not even be on the org chart, but clearly needs to be. This is where a strong Business Advisor is worth their salt: the CEO needs to be told, in no uncertain terms, that these two functional areas are failing. Add to the plan: Create CRO Role; Improve CFO Performance.

The Management Team rates well, with 7 for both the Org Chart and Compensation, and 10 in Reporting Relationships. You’ve learned during the Deep-Dive Analysis that the client’s comp system rates a 7, is competitive and tied to performance. Open question: does comp at every level need to be adjusted to drive behavior towards the company’s objective? Considering the demands that will be placed on the entire organization, add Audit and Monitor Compensation to the plan.

Chart of Human Resources, Toplift rates 6.4 of 10

The firm is delivering satisfactory $200,000 GR per employee. Assuming this production holds, to reach the GR goal will require hiring 17 new employees, who will need to generate revenues as early as possible.

Human Resources was originally a “Priority” but this may change as the plan is shifted into gear. The function will need to remain strong to recruit, train and incorporate 17 new team members. This presents a great opportunity for collaboration between the existing HR team and outside consultants, and the plan can call this out. Toplift’s Human Resources sub-driver Recruitment is rated a 5 of 10; further Comp and Benefits is a 7 of 10. Add to the Strategic Plan: Hiring Producers and Support; Designing and Deploying Compensation Based on Attaining Revenues and Margin.

Remember how we discussed the CoreValue Drivers and gears in an engine? The new recruits must be immediately participate in sales training, and held accountable in the new sales process. Think CRO. Add this as weight to the scale for prioritizing the Sales Plan & Process value driver in the plan.

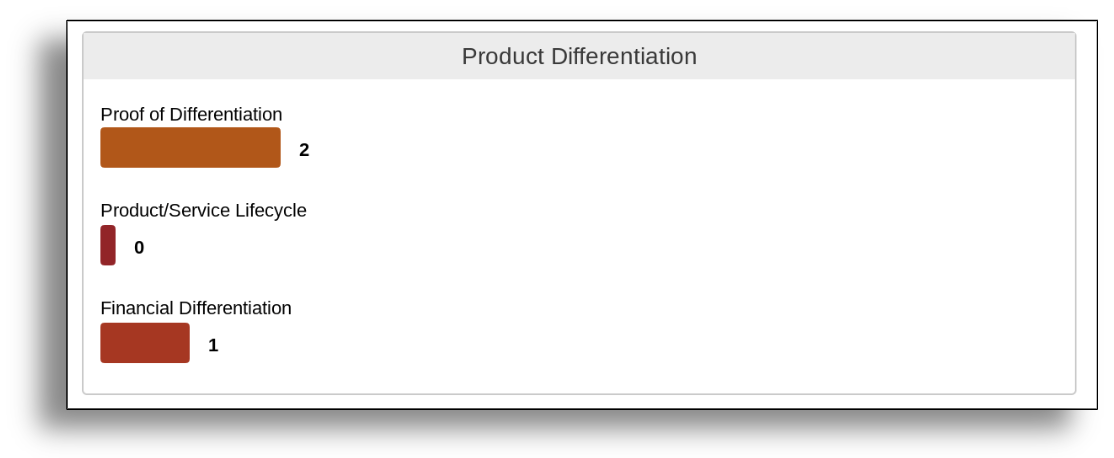

Product Differentiation. High Priority.

Chart of Toplift’s Product/Service Analysis; CoreValue Business Rating 1.1 of 10

The third Strategic Factor to be added to Toplift’s Strategic Plan is found in the service suite itself. Toplift appears to be selling its service as a commodity, with very weak ratings in all 3 Product Differentiation sub-drivers. The goal is to sell more services at deeper margins (raise price and/or create efficiency), and the product management and marketing teams have work to do. Add “Creating a Differentiated Product” and “Financial Differentiation” to the plan.

Nb: Given Toplift’s strength in the sub-drivers of Recurring Revenues and Customer Satisfaction, once the original plan is deployed the Business Advisor and CEO may update the Strategic Plan adding Create Additional Synergistic Services. This will increase per-customer revenues. Given the tight time frame, it is unwise to add this complexity to the initial plan. Goals can be static, but strategy will evolve based on tactical factors. See Strategy in Action: “strategy and execution must be twins joined at the hip.”7

Putting it all together: here’s are selected elements for the Strategic Plan to reach $2MM Net Revenues (3 Strategic Factors only)

- Client Objective : $2MM Net Revenues (annualized) within 18 months

- Is the Objective Attainable?

- Analysis 1: Unlock Deep-Dive Analysis of Company Strength

- Analysis 2: Cash Required to For Projected Growth

- Strategic Factors (sub-objectives)

- New Clients: Increase Gross Revenues

- Create, deploy and manage new sales (revenue generation) process

- Create CRO Role

- Hire Producers and Support

- Create and deploy sales training for new and existing staff

- Design and Deploy Compensation Geared to Attaining Revenues and Margin

- Deeper Net Margin

- Revamp CFO Role

- Differentiate Service Product, re-design as premium service

- Marketing

- Improve Firm and Service Positioning --premium

- Increase Brand Value

- Lead Generation

- Product Management

Note how the strategic factors impact each other, like the gears in an engine. Good strategic plans will cover all of the gears, and prioritize work on those directly contributing to the client's objective.

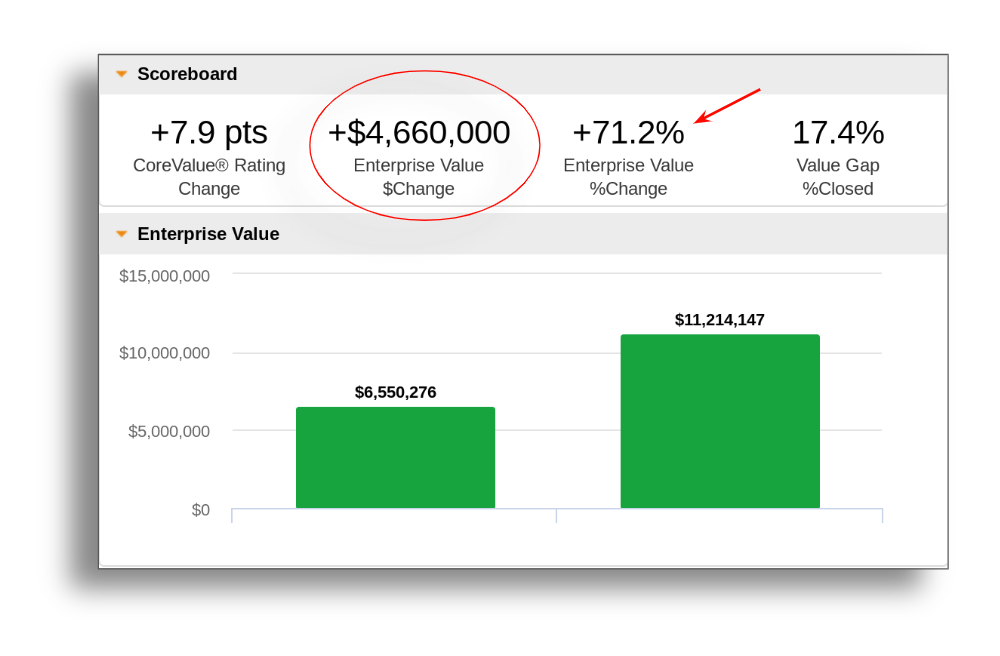

What's the big win? Successfully reaching the objective is great. But remember this: for every dollar of net income, you are helping generate multiples of value. By reaching the objective, and implementing best practices in just the Value Drivers described here, this Business Advisor helped increase Shareholder Value by 71.2%. Does this put advisory fees in the proper perspective? You bet it does. Check it out:  This article has covered selected factors the Business Advisor includes in a strategic plan as the Architect creating a Blueprint. Converting the Plan into Action is explained in Business Advisor Training. Next time you are reviewing a client or prospect’s website or having a discovery conversation, look and listen for their Mission and the Strategy needed to achieve -do both exist? If not, can you help? This discovery is a terrific opportunity for you to connect your skills and expertise with your client’s operational challenges.

This article has covered selected factors the Business Advisor includes in a strategic plan as the Architect creating a Blueprint. Converting the Plan into Action is explained in Business Advisor Training. Next time you are reviewing a client or prospect’s website or having a discovery conversation, look and listen for their Mission and the Strategy needed to achieve -do both exist? If not, can you help? This discovery is a terrific opportunity for you to connect your skills and expertise with your client’s operational challenges.

Do you have thoughts or comments? How would you improve this article? We’d love to hear from you. Please comment here, or shoot an email to blog@corevalueforadvisors.com

Additional Business Advisor Resources, click a topic to view:

- Marketing Resources: available to the public

- Free Webinars. New! Marketing Tactics for Business Advisors

- Business Advisor Training Calendar

- CoreValue Advisor Conference

[1] Kenny, Graham: Your Strategic Plans Probably Aren’t Strategic, or Even Plans, HBR April 06 2018. https://hbr.org/2018/04/your-strategic-plans-probably-arent-strategic-or-even-plans

[2] For a discussion of business advisor roles, click here.

[3] See e.g. CoreValue ‘Unlock’ Deep-Dive Analysis and its Operational Strength and Value Report.

[4] Toplift is a fictitious name. The analysis is for illustrative purposes only, and replicates anonymized data from companies analyzed using CoreValue®.

[5] Mullins, Neil C. ChurchillJohn. “How Fast Can Your Company Afford to Grow?” Harvard Business Review, 1 Aug. 2014, hbr.org/2001/05/how-fast-can-your-company-afford-to-grow.

[6] © CoreValue Advisor Software. CoreValue US Patent 9,607,274

[7] Zweifel, Thomas D. “Strategy-In-Action: Marrying Planning, People and Performance (The Global Leader Series Book 4) EBook: Thomas D. Zweifel, Edward J. Borey: Kindle Store.” Amazon, Amazon, www.amazon.com/Strategy-Action-Marrying-Planning-Performance-ebook/dp/B00E0TFVL0.