Growing Revenues vs. Growing Equity Value: Learning the Differences

Business Advisor Series Article 7: Part 1 of a 3 Part Series

Understanding the CEO’s goal is the predicate for planning an engagement, since a plan without a goal is a voyage without a destination.1 Goals drive strategy. So when a CEO says that they want to grow, what do they mean?

The top three advisory goals2 reported by CEOs are:

Goal 1: 'Grow' (59% of clients want to increase revenues and profits)

Goal 2: 'Strengthen Operations' (20% want to make the company easier to run), and

Goal 3: 'Prepare to Sell My Company' (19% want equity planning or to prepare for M&A due diligence).

Word to the wise: ‘Grow’ and ‘Prepare to Sell’ are actually both “growth” engagements. Why? The first CEO wants to grow revenues; the other wants to grow equity value. Further, according to data from Pinnacle Equity Solutions3 83% of “Prepare to Sell” CEOs actually need to grow revenues in order to create the equity value they need to fund their personal wealth plans. Meaning, they set out to sell their company and end up needing to grow it. Inescapable conclusion: most clients want/need planning engagements that deliver revenue growth.

While growing revenues grows equity value the vice versa doesn’t apply; nor is equity value growth dependent on revenue growth.

- Equity value growth can simply be risk mitigation: "Here are the due diligence holes to fill to increase the existing value you can harvest;" this is transaction-centric planning

- Revenue growth is strategic planning and execution: "Do X, Y and Z and revenues will increase;" this is strategy-centric planning

They overlap, but only some.

This article discusses growth planning, or being the architect. The architect’s plan will be executed by the general contractor: a trusted advisor who engages as a peer with the CEO to convert the plan into reality. The architect and GC can be the same person. The GC helps to manage plan execution, collaborating with the internal executive team and outside experts as needed. The Architect role is strategic; the General Contractor role, similar to the CEO role, combines strategy and tactical execution.

Planning Growth

Chart 1: ‘Private Business Standard’ Operational Best Practices4

When creating the growth plan, it is useful to rely on a standardized methodology5 which provides a holistic understanding of the client company. This holistic understanding provides the basis for comprehensive planning. Comprehensive planning can be distinguished from subject area planning: for example, the comprehensive growth plan might include a subject matter marketing plan.

When planning to grow equity value, the holistic methodology shows clients the links between operations and company-specific risks. By creating a plan to reduce these risks, advisors can help clients increase equity value without increasing revenues. This planning simply mitigates risks.

When planning to grow revenues, the standard methodology and technology facilitate the collaboration of expertise around common goals. The analysis rates the company’s value drivers against best practices. Think of the value drivers as the gears in the business engine; the output of the engine is revenue and profit. Strengthening the engine increases the revenue outputs. Simultaneously, this reduces risk: the client is therefore double-dipping revenues and value, increasing both earnings and the multiple applied to them.

Revenue and equity growth planning engagements share these common steps:

- Identifying the client’s goal

- Analyzing the client company value drivers

- Prioritizing the value drivers using the client’s goal for guidance

- Preparing a plan to strengthen the priority value drivers; this plan is the deliverable

With the client’s goal in hand and the strength of the value drivers understood, the business advisor applies her expertise, creating a plan that lists and prioritizes the strengthening of select value drivers. When creating the client plan, strong value drivers simply need to be documented; weak value drivers need to be improved and documented. For example, ‘growing revenues’ depends on a strong value driver for selling into a large potential market. If a large market exists, the plan will simply document this fact; if the company needs to increase the size of the market it reaches in order to grow, action is required.

Let’s unpack the planning process using the Toplift Services PLLC case. Toplift Services is a professional services firm. Toplift’s industry is undergoing significant consolidation, and Toplift’s shareholders want strength in the market. Toplift is still being buffeted by the after-effects of the great recession. Although they are generating acceptable per-employee revenues, they are competing on price (rather than value), resulting in net revenues below the industry norm.

Toplift’s gross annual revenues are $10MM. Toplift’s new CEO Elizabeth Smith has defined her goal as increasing net revenues from $500M to a $2MM run rate within 18 months. The analysis of Toplift’s value drivers are summarized in Chart 2.

Chart 2: Toplift Overview, Enterprise Value, and CoreValue Rating

The business advisor, meeting with the CEO, will have completed the analysis of Toplift’s operations. This analysis creates a comprehensive understanding of the totality of the company’s market and operational areas. The business advisor will use this understanding when creating Toplift’s plan.

Chart 3: Example of Value Driver Analysis

As an example of the information created by a deep-dive analysis, the Sales & Marketing value driver has six sub-drivers. Toplift has an effective marketing process, run by their Director of Marketing, with a 10 of 10 rating. Toplift is using engagement agreements with all of its clients (Rating 10 of 10), and the firm uses clear metrics to measure marketing performance (Rating 10 of 10). However, the firm professionals are also the defacto sales force and only have general sales objectives (Rating 3 of 10). Further, they are operating without a sales plan or standardized process (Rating 0.6 of 10). Converting leads into paying clients --and thereby growing gross revenues-- requires 10-10 in all areas.

Growing Revenues vs Growing Equity Value

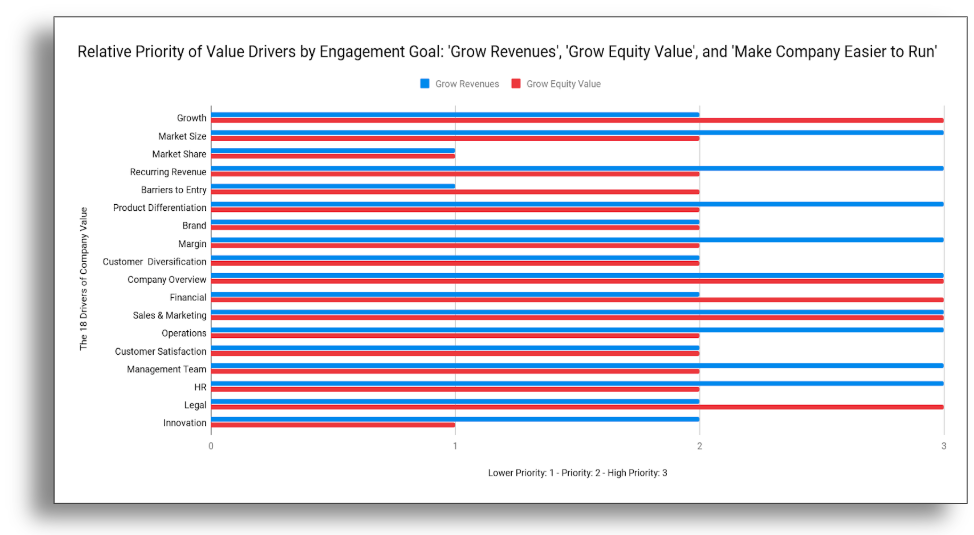

We will start by discussing the value drivers and their priorities in line with the goal “Grow Revenues.” We will then contrast the priorities against a “Grow Equity Value” engagement. The value drivers have different levels of priority, determined by the CEO’s goal. Each of the value drivers is therefore designated as Lower Priority, Priority, or High Priority. Note lower, not low.

Value Drivers, relative engagement complexity

Growing Revenues:

- 9 high priority

- 5 priority

- 2 lower priority

Growing Equity Value:

- 5 high priority

- 11 priority

- 2 lower priority

Chart 4: Relative Priority of Value Drivers by Engagement Goal

Goal 1: Growing Revenues

To grow revenues and profits, the first question is whether Toplift can reach their net revenue goal at today’s gross revenues. Related, at the 18 month mark can Toplift increase net revenues from 5% to 20%, while creating an organization that is healthy and thriving? Here’s a useful sports analogy: if the company stops swinging the club when it’s at the ball, i.e. net revenues, they can clearly cut their way to the goal. This is slash and burn, a P&L slight of hand. Toplift will reach the goal, on their way to oblivion. To drive from the tee to the green the company needs to be swinging through the ball, driving through the objective with power to spare. Slashing is easy, planning less so.

Commitment, speed and the focus on profit give this engagement a high level of complexity. This complexity begs for careful planning. Planning considers both the capital and expertise needed to execute the growth plan and reach the goal. While clients might normally assume that planning is a “nice to have” rather than required, in fact growth planning ensures that time, treasure and expertise are deployed efficiently, minimizing investment by guarding against waste. This contributes to maximizing the project’s ROI.

Before we turn to the value drivers, one must answer this question: can the client afford the growth needed to hit the revenue goal within the specified time frame? By planning how the client company will fund the growth plan --from cash reserves, organic income, or outside funding --the business advisor is providing a critical service. There is of course a formula for calculating the rate of growth the client’s organic cash can fund.6 This analysis is a predicate to revenue growth planning.

Here is the relative priority of the value drivers based on the goal “Grow Revenues.” This prioritization is not Toplift-specific, it is determined by the goal itself.

Chart 4: Relative Priority of Value Drivers for ‘Grow Revenues’ Engagement

We note immediately that there are nine ‘High Priority’ value drivers. How are these relevant to planning --what needs to be done? The comprehensive plan:

- Write the Strategic Plan to reach $2MM net revs in eighteen months --use information from Company Overview value driver (includes Mission). Toplift may also need to change their business model, see below

- Holding the Senior Team accountable to executing the plan --best practices from the Management Team value driver

- Moving from a commoditized service to a value-based service at industry or better margins --Margin value driver; note this operational gear meshes with Product Differentiation, and with Toplift’s business model in Company Overview

- Differentiating Toplift’s services so the company can compete on value rather than price --Product Differentiation value driver

- Hiring the extra professionals needed to generate additional revenues --HR value driver

- Creating and deploying a marketing plan to generate new client leads, and a sales plan/process to convert prospects into clients --Sales & Marketing value driver. This may be highest priority value driver, but cannot be strengthened in a vacuum (value drivers are gears in an engine)7

- Ensuring existing clients remain in the fold, while converting them to value-based services --Recurring Revenues value driver; impacts Sales & Marketing

- Ensuring Toplift’s services are offered into a large market --Market Size value driver. Note that creating strength in this area might require re-designing/diversifying services, see Product Differentiation

- Being able to deliver the engagements won by sales to new and existing clients -Operations value driver; since Toplift’s services are people-based (selling expertise), this also impacts HR

Subject matter planning falls short because it strengthens one value driver in a silo. Comprehensive planning considers each value driver as a gear, connected to the other gears in the engine. Through comprehensive planning the client gains holistic control of the entire operation. Planning delivers efficiency and ultimately success: companies enacting a comprehensive plan have a proven record of generating an average twenty one point six three percent (21.63%) revenue growth.8

The strategy-centric planning required to grow revenues differs in complexity from the transaction-centric planning to grow equity value and preparing a company for sale. Value growth planning will be discussed in next week’s article, stay tuned.

Recap:

- 80% of CEOs want or need to grow revenues and value

- Clients benefit from growth planning due to the efficient deployment of expertise and capital delivered by the planning process --maximizing engagement ROI

- The business advisor is the architect, delivering a blueprint for growth; the business advisor can also act as a peer to the CEO, helping to manage plan execution

- Growth engagements include defining a clear goal, analyzing the client’s value drivers, and delivering a plan to strengthen weak drivers

- There are standardized methodologies, technology and training that support the business advisor winning growth planning engagements and delivering client growth results

~~~~~~~~~~~~~~~~~~~~~~~

#DRIVEGROWTH: The CoreValue Advisor Conference in November will cover this and many additional topics, so save the date and register here.

We’d love to know what you think, please join the conversation by posting below. Questions can also be emailed to blog@corevalueforadvisors.com.

Footnotes:

[1] “Chapter 2: Developing a Strategy.” Harvard Business Review Leader's Handbook: Make an Impact, Inspire Your Organization, and Get to the next Level, by Ronald N. Ashkenas and Brook Manville, Harvard Business Review Press, 2019.

[2] CoreValue data ©2011-2019

[3] Courtesy Pinnacle Equity Solutions, results of Business Exit Readiness Index™ surveys performed by Certified Business Exit Consultants with owners of ~2,000 middle market companies. ©2016-2019 Pinnacle Equity Solutions, Inc.

[4] CoreValue® US Patent 9,607,274

[5] See NACVA CEO Parnell Black’s letter to Members 1Q2019, published April 8 2019: https://www.nacva.com/content.asp?contentid=705

[6] For a related article, please visit http://www.corevalueforadvisors.com/knowledge/how-fast-can-your-company-afford-to-grow

[7] According to data from CoreValue, lack of a proven and documented Sales & Marketing process is the largest single detractor to value. This value driver is a prime example of subject-specific consulting which is delivered in a silo, with little or no consideration to the comprehensive business needs.

[8] See: Virginia Domestic Markets Expansion Program, https://online.flippingbook.com/view/887165/