Making the Team Accountable for the Growth and Equity Value of your Business

Business is really just people executing processes to generate revenues - how do you create accountability for best practices?

First, some housekeeping:

- The CoreValue Conference is being moved to February, when we will offer a live and broadcast event. Stay tuned.

- George Sandmann is leading the NACVA 'Drive Growth: the Business Advisor Boot Camp' Nov 19-20 and Dec 3-4. Lots of CPE. All are welcome, please click here for more info and to register. The Boot Camp is being updated to incorporate the 3 Dimensions of Business Growth.

#drivegrowth

Feature Article

Feature Article

Your client came to you for help driving growth by identifying and neutralizing company-specific bottlenecks.

You know that businesses are fundamentally (i) groups of experts, who are (ii) executing business processes, which (iii) generate revenues.

The group of experts is typically divided into managers and employees, who are collectively responsible for execution. Well-run companies execute according to best practices. So you’ve armed yourself with a list of business process best practices. Now, how do you connect people with processes, and make them accountable for success?

How do you hold everyone’s feet to the fire?

The answer starts with communicating what people are accountable for doing, and to whom. Best practice is creating three-part job descriptions for all managers and employees that include:

- the title - preferably descriptive of the role

- what the role is accountable for

- to whom the role is accountable

Since strong Growth and Equity Value Drivers drive success, they can be referenced when writing senior management and employee job descriptions. And by defining roles by referencing the Growth and Equity Value Drivers we can immediately connect the organizational chart to the business engine.

Here are examples of job descriptions. You can use these as templates when helping clients to create accountability. Think in terms of Strategic Roles, and Tactical Roles. Strategic Roles are management roles connecting goals (vision and strategy) to execution. Tactical Roles are “doing” roles, executing the business processes.

Note: the following job descriptions assume a written vision and strategy, and a plan to execute the strategy. However, 22% of companies do not have a strategic plan; plus the top Red Flag threats to growth and equity value are loaded with ‘roles and responsibilities’ problems. The wise Growth Consultant starts by discovering where their client stands in both of these areas.

Does your client CEO understand all of her roles? She may be the largest shareholder, the Chairman of the Board, the CEO, and the President… these are very different jobs.

Here are some examples. Note that the ladder of accountability has ‘Equity Value’ at the top. How well are your clients executing their roles?

Strategic Roles

- Board of Directors: The Board of Directors is accountable (i) to the shareholders for creating business strategy to further the business vision and maximize equity value, and (ii) for holding the CEO accountable for successful strategic execution. CoreValue Driver #10:6 Strategy

- CEO: The CEO is accountable to the Board of Directors for maximizing equity value by managing business strategic execution, guided by the business vision and strategy. CoreValue Driver #15 and #10:6

- CFO: The CFO is accountable to the CEO for ensuring that the business follows best financial predictive and reporting practices so that the business can successfully execute its strategy. CoreValue Driver #11

Tactical Roles

- President: The President is accountable to the CEO for successful tactical execution of the business strategy, and for successfully meeting operational and financial goals. CoreValue Driver #15:1 and 3

- VP Sales: The VP of Sales is accountable to the President for creating and executing the sales process, ensuring that the business produces revenue in a proven and systematic way, ensuring that the business is sustainable and scalable. Responsibility includes marketing (lead generation) and sales (conversion of leads to revenues). CoreValue Driver #12

- VP of Operations: The VP of Operations is accountable to the President for delivering on the sales promises made to the marketplace and to do it in a systematic and process-driven manner. CoreValue Driver #13

- Controller: The Controller is accountable to the CFO for maintaining the chart of accounts enabling fast and effective communication of financial information both internally and externally, and for generating the income statement and balance sheet by the fifth business day of each month and the cash flow statement by the first business day of each week. CoreValue Driver #11:1

- Delivery Team Member: The Delivery Team is accountable to the VP of Operations for successfully executing the Delivery Process and meeting Delivery Objectives. Success means delivering 12 units per day each of which meets or exceeds minimum Quality Metrics. CoreValue Driver #13:1, 2 and 3

In lower middle market companies the founder is often the principal shareholder, as well as the CEO and President. As businesses grow, these roles must be separated.

How Do You Drive Accountability?

Your client’s business is an engine, and the gears of the engine must work in synergy to deliver growth and high equity value. Experience shows that you cannot assume alignment between members of the senior team when it comes to where the engine is going, or how well the gears are working.

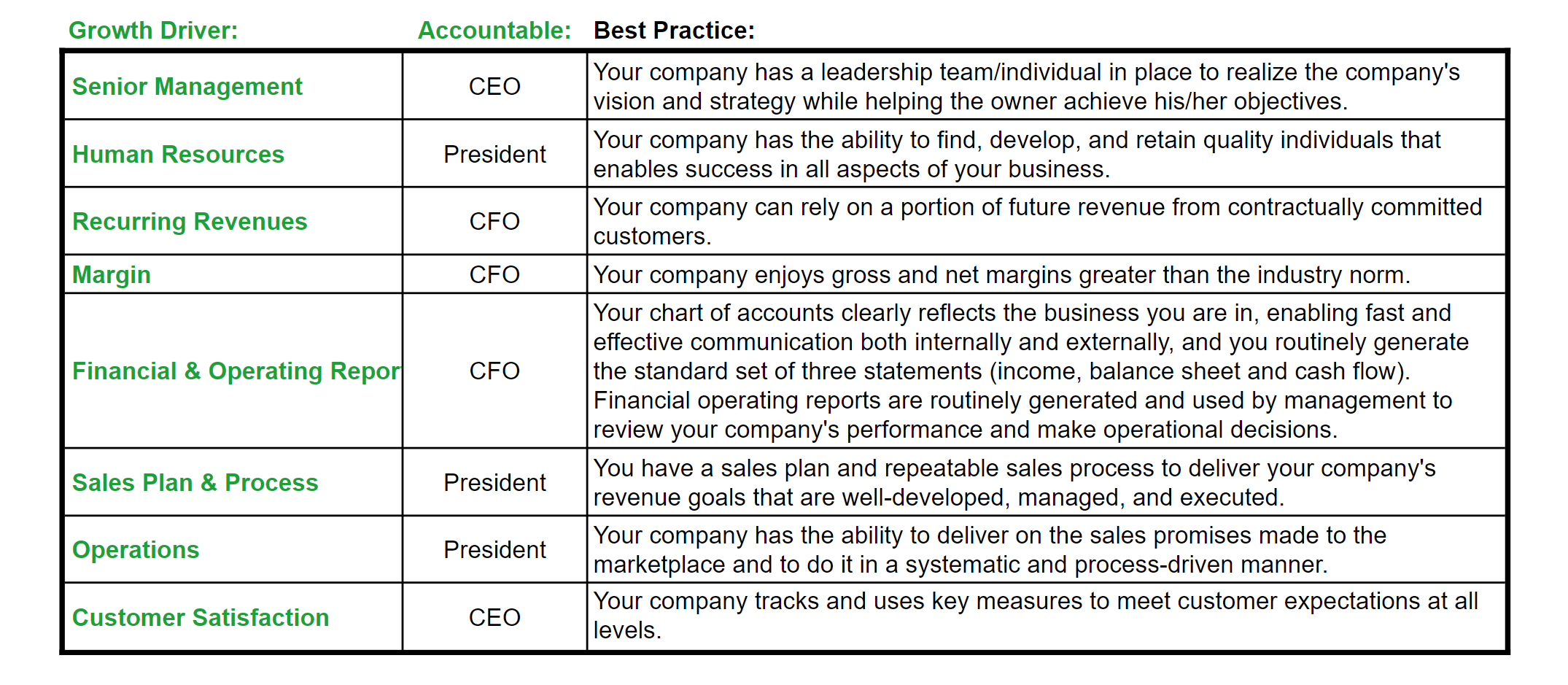

To create alignment and accountability, start by holding a meeting during which you discuss each of the growth and equity value drivers. This can be done by running CoreValue Discover with the senior team - consider having each person complete Discover privately, then comparing their reports to identify misalignment. You can use the Discover Report and 18 Value Drivers to guide a conversation in which the senior team collectively agrees on the 1 person who will be accountable for maintaining best practices in each area. The conversation will center on both accountability and collaboration.

Go through the list 3 times. The first is a draft, spit-balling who will have accountability. The second pass should consider the relationship between growth drivers, during which you can fine-tune assignments. The third is a final confirming pass - have you reached synergy and load balancing?

What will bubble up is that the senior team must collaborate to be succesful. Here are some examples that illustrate team collaboration.

Collaboration to Integrate Best Practices - 5 Examples, and you must identify the 1 person who will be accountable for implementing best practices:

- Recurring Revenues: success requires collaboration between Sales, Operations, Financial and Legal. Which member on the senior team is ultimately for ensuring a high percentage of revenue is recurring: the VP of Sales? COO? CFO?

- Financial Operating Reports: collaboration between Senior Management, Sales, Operations and Finance

- Customer Satisfaction: collaboration between Operations, Human Resources (Right People Doing the Right Things Right, thank you Mr. Harnish), and Sales

- Brand: brand has layers, and strength depends in the first degree on Customer Satisfaction, Operations, Marketing, and in the second degree on Human Resources and Product Differentiation

- Barriers to Entry: creating and maintaining barriers is a collaboration between Legal, Finance, Operations, and Product Differentiation

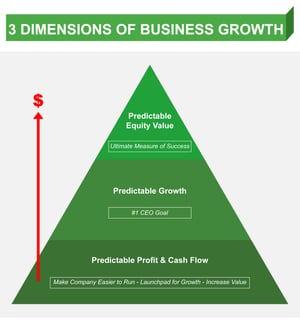

Balancing Accountability Across Staff and Over Time: 3 DoG

This is where the 3 Dimensions of Business Growth again proves valuable. If you are creating a launchpad for growth, you’ll start with the First Dimension, creating Predictable Profits and Cash Flow.

Since you will be focusing on 8 high-priority growth drivers, you can balance the work load (i) across staff and (ii) over time. Load balancing depends on the senior team - if the CEO has her name next to 6 of the 8 areas, and the CFO next to 1, there is a great opportunity to delegate.

Here is an example of assigning accountability:

The CEO will in addition be accountable for success of the project, which is arguably an additional load. Here, the overall load is well balanced.

Think about spreading the work on these 8 areas out over 4 months - roughly 2 weeks per. This allows each exec to focus on their core role, adding a strategic project for a defined, limited time.

The result? Senior management knows where the business is going, understands the growth drivers for success, has accountability, and will collaborate as a team - on a defined schedule. You're helping your client build one heck of a launchpad.

Would you like to know more about senior teams? Here’s an interview/case with corevalue-powered advisor Larry Prince of Prince Leadership, in which we explore his experiences consulting about Senior Management issues. See all the other great videos here.

Want to learn more? We're glad to help, just email george@corevalueforadvisors.com or fill out the form at right.

We'd love to know what you think, please email blog@corevalueforadvisors.com or comment below.