How do you improve client engagement results by understanding (1) goals, (2) processes and (3) priorities?

Business Advisor Series Article 4

Understanding the CEO’s goal is the predicate for planning the engagement, since a plan without a goal is a voyage without a destination.1 Goals drive strategy.

The top three advisory goals2 reported by CEOs are:

Goal 1: 'Grow' (59% of clients want to increase revenues and profits)

Goal 2: 'Strengthen Operations' (20% want to make the company easier to run), and

Goal 3: 'Prepare to Sell My Company' (19% want equity planning or to prepare for M&A due diligence).

Delivering engagement results in line with each of these goals will require the Business Advisor to prioritize work within the company. This begins with setting a baseline understanding of the company’s operational strength. The data shows that improving operational strength delivers growth and value. But which operational areas have a high priority?

The CoreValue operational analysis shows which processes are strong, and which are weak. The analysis compares each process to best practices in eighteen areas, known as value drivers. The eighteen value drivers comprise the totality of a company’s operations. These are the gears in the business engine; the output of the engine is revenue and profit.

Strong processes simply need to be documented; weak processes need to be improved and documented. Deciding which processes to prioritize in an engagement is determined by the CEO goal. For example, selling products into in a large potential market is critical to growing revenues; but accessing this large potential market is not critical if the goal is simply to strengthen operations and make the client company easier to run.

Let’s look at the issue through a case study. Following is summary information for Baker Manufacturing, a case used in CoreValue's training and practice development courses.

Chart 1: Summary Information for Baker Manufacturing

The engagement was prompted by Baker receiving an unsolicited offer to purchase. Baker's CEO had two main questions: (1) was the unsolicited offer good, i.e. at a fair price, and (2) would the offer price survive due diligence? To answer these questions Baker’s Business Advisor prepared an Operational Strength and Value Report based on a deep-dive operational analysis.

Chart 2: Baker Manufacturing’s Value Gap Waterfall, with contribution to the Value Gap listed highest to lowest

Baker has $3.8MM of its value at risk (Total Value Gap).3 The two highlighted value drivers contribute 18% of the risk in dollars. Determining whether the unsolicited offer price is fair and attainable is straightforward. In this case, as is the case with 84% of Middle Market business owners, the current value of the business is not sufficient to meet the CEO’s wealth goals.4 This could change the CEO’s goal from ‘Prepare to Sell’ to ‘Grow.’

To line up engagement priorities (and deliver a compelling proposal), savvy Business Advisors prioritize the sub-projects inside the engagement to ensure success. For guidance, in the following chart each of the eighteen value drivers is rated from 1 to 3 based on it’s priority for reaching each CEO goal:

Low Priority = 1

Priority = 2

High Priority = 3

Chart 3: Relative Priority of Value Drivers in 'Grow', 'Strengthen Operations' and "Prepare to Sell' Engagements

As the chart shows, planning to ‘Grow’ is the most challenging: to unlock growth there are 8 High Priority value drivers, an additional 6 are Priority (14 of the total 18 value drivers). Growth therefore needs to be planned carefully as it is difficult, time consuming, disruptive, and costly.

‘Prepare to Sell’ is second in complexity. The benefits of equity planning become clear: the further in advance a business owner begins to work preparing for an orderly transfer, the better. Sell has 6 High Priority drivers, and 9 Priority.

Contrast this with 'Strengthen Operations' for which 2 value drivers are High Priority and another 8 are Priority. Strengthen Operations is a powerful and high ROI path to stabilizing the client and creating options for the future.

Note: of the 13 value drivers which are High Priority, there are only 3 which overlap for 2 of the goals, and 0 which overlap for all 3 goals to Grow, Strengthen, or Prepare to Sell.

Let's unpacking two value drivers as examples.

Example 1: 'Large Potential Market' Value Driver

Chart 4: Large Potential Market Gap analysis, from the Baker Operational Strength and Value Report

Large Potential Market creates 11% of Baker’s total at-risk value (see Chart 2). Looking at the strength of the 4 sub-drivers5 in the right-hand column, we see consistent weakness which rolls up to a weighted strength rating of only 0.8 of 10. The dollar value for strengthening this driver is clear --but does the client care? Goals provide the answer.

Goal 1: Grow

To Grow, Large Potential Market is high priority and a must-fix --the market itself limits growth. This is a big lift. Strategies for increasing Large Potential Market can include a physical move, wider distribution, new channels, M&A, and more. Note that Baker is also weak in Product Differentiation. One answer may be to create new products or services which will open new markets. More careful planning is needed: creating new products, while valuable, is costly.

Goal 2: Prepare to Sell

When Preparing to Sell, not serving a Large Potential Market (best practice: >$1 Billion) may be an immovable drag on price which will need to be handled head-on in due diligence.

Goal 3: Strengthen Operations

If however the goal is to Strengthen Operations, Large Potential Market has Low Priority. Improving this value driver does not directly make the company any easier to run. The Business Advisor may recommend ignoring Large Potential Market, even if it is a big drag on value. In fact, thinking through a long-term engagement, once the client’s operations have been improved, the Business Advisor can help plan measured growth --in contrast to the potential chaos of unplanned growth.

Example 2: Recurring Revenue

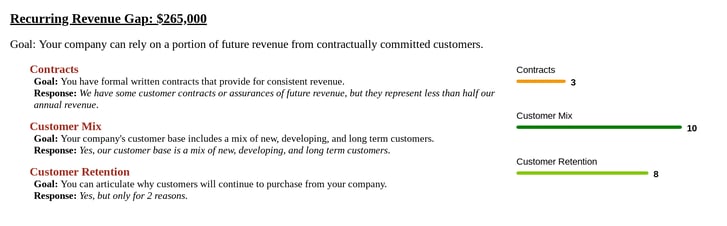

Chart 5: Recurring Revenue Gap analysis, from the Baker Operational Strength and Value Report

The operational strength of Baker Manufacturing’s Recurring Revenue driver is moderate at 5.9 of 10. One can see at a glance that the company has a mix of new and long term customers (rating of 10), retains their customers over time (rating of 8) but has not put a process in place to use contracts (rating of 3). Contracts have the highest weight; lack of physical contracts depresses the overall rating.

The operational strength of Baker Manufacturing’s Recurring Revenue driver is moderate at 5.9 of 10. One can see at a glance that the company has a mix of new and long term customers (rating of 10), retains their customers over time (rating of 8) but has not put a process in place to use contracts (rating of 3). Contracts have the highest weight; lack of physical contracts depresses the overall rating.

The answer to re-capturing this $265,000 of the value gap is clear, and relatively straight forward: convert habitual buyers into contracted customers. The Advisor can propose a low-disruption project with a high ROI.

Goal 1: Grow

If the CEO’s goal is Grow, implementing a contract (or similar) process with customers is a High Priority with low disruption and cost. In Grow, the contribution to value of the driver is a secondary consideration.

Goal 2: Prepare to Sell

Recurring Revenue is High Priority for Prepare to Sell. Based on the analysis of over 5,000 closed transactions, CoreValue’s algorithms include weighting which calculates the importance of this value driver. If they want to sell at a high price, Baker Manufacturing must be able to produce documentation in due diligence which proves tomorrow’s revenues are low risk --evidenced by customer contracts.

CEOs often begin engagements with the goal to ”Prepare to Sell.” This changes to “Grow” when they discover that the net proceeds of the sale will not fund their personal wealth goal. This underscores the importance of the basics: the overarching goal is to deliver value to the shareholders. As Harnish discusses in Scaling Up, growth and value are the twin measures of company success.6

Goal 3: Strengthen Operations

For the client who wants to make their company easier to run, Recurring Revenues is simply a Priority as it takes the pressure off of sales and marketing. In the lower middle market especially, the CEO is often intimately involved with sales, putting significant demand on their time. Improving Baker’s score in the Contracts sub-driver is a linchpin to creating the bandwidth needed to focus on Operations, which is one of the two High Priority value drivers for the Strengthen goal.

Conclusions:

- Successful engagements start by identifying the CEO’s goal

- The Business Advisor uses the operational analysis to highlight weak operational drivers

- Project priority for strengthening weak drivers is determined by the CEO goal

- By improving relevant operational strength, the Business Advisor provides high efficiency/high ROI success towards the goal

- Equally important, the Business Advisor has created new options for the client --strength leads to growth; growth increases value, etc.

If you would like to learn more about how the CoreValue Advisor Software proven process can help your practice, you can register for the next 30 minute intro webinar.

~~~~~~~~~~~~~~~~~~~~~~

1. “Chapter 2: Developing a Strategy.” Harvard Business Review Leader's Handbook: Make an Impact, Inspire Your Organization, and Get to the next Level, by Ronald N. Ashkenas and Brook Manville, Harvard Business Review Press, 2019.

2. Data generated from business advisor use of CoreValue Discover with CEOs for over 10,000 middle market companies.

3. While the initial assessment of company strength and value calculated a Value Gap range of $1.8MM to $3.35MM, the deep-dive analysis determined that the total Value Gap was $3.8MM. This highlights the importance of confirming, as the deep-dive analysis does, that processes are proven, systematic, and documented.

4. Courtesy Pinnacle Equity Solutions and the Business Exit Readiness Index™.

5. CoreValue’s 18 Value Drivers each have between 3 and 8 sub-drivers, or best practices. CoreValue US Patent 9,607,274.

6. Harnish, Verne. Scaling up: How a Few Companies Make It ... and Why the Rest Don't. Gazelles Inc., 2015.