Driving Growth using the 'Predictable Profits and Cash Flow' Launchpad. #drivegrowth

The first article in this series discusses the First Dimension of Business Growth: creating Predictable Profits and Cash Flow. We’ve updated that article with some new thinking, to check it out click here.

Second Dimension of Business Growth: This week we are adding a definition, plus a new concept, then moving into helping you drive engagements creating Predictable Growth.

Definition: ‘Predictable’, defined in the context of the 3 Dimensions of Business Growth. There is a different definition for “Predictable” depending on your client’s industry. Ed Wandtke, MBA CVA CEPA, is writing this up now - and we’ll publish it when done. The key is that “predictable” means you are “highly confident” in future results. CoreValue Advisor Software’s very heart is analyzing confidence in a business’ ability to generate revenue and profit going into the future, since creating high confidence creates high equity value.

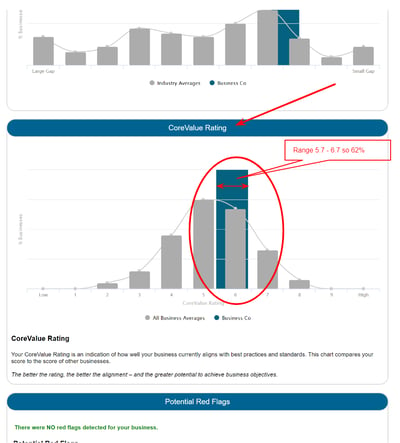

New Concept: ‘Confidence’: CoreValue calculates a business rating. The magic is that the business rating helps calculate where a business will fall in the normalized trading range for your client’s industry. High business rating = top end of the range of multiples… barring any Red Flag threats. If you think of the CoreValue Business Rating as a 'Confidence Index', you can easily communicate the analysis to your client. A CoreValue Rating of 6.2 is explained like this: “Jane, you can be 62% confident that your business will predictably generate revenue and profit going into the future." Following up with "Tell me, would you be interested in discussing techniques for driving higher confidence in future performance?” and you're going to start winning engagements.

New Concept: ‘Confidence’: CoreValue calculates a business rating. The magic is that the business rating helps calculate where a business will fall in the normalized trading range for your client’s industry. High business rating = top end of the range of multiples… barring any Red Flag threats. If you think of the CoreValue Business Rating as a 'Confidence Index', you can easily communicate the analysis to your client. A CoreValue Rating of 6.2 is explained like this: “Jane, you can be 62% confident that your business will predictably generate revenue and profit going into the future." Following up with "Tell me, would you be interested in discussing techniques for driving higher confidence in future performance?” and you're going to start winning engagements.

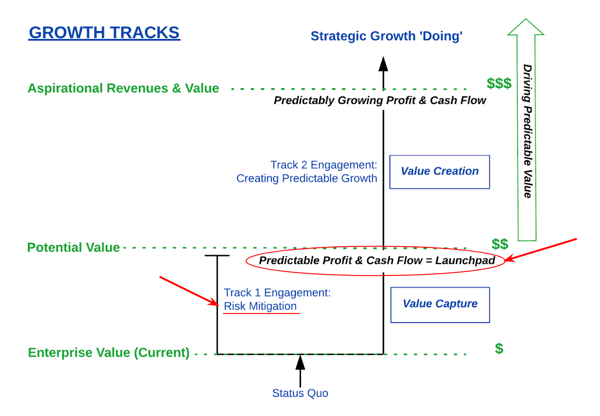

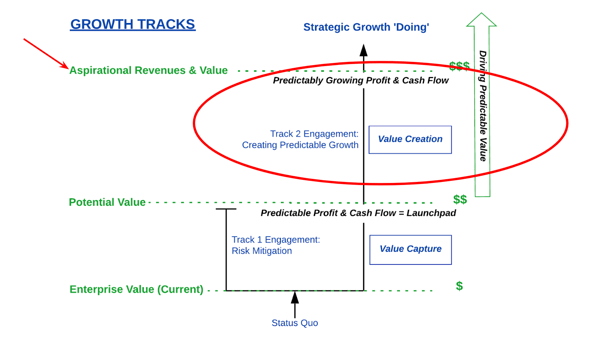

Why? Because Predictable Profit and Cash Flow is the launchpad for predictably growing your client’s business and reaching your client’s aspirational revenues and value.

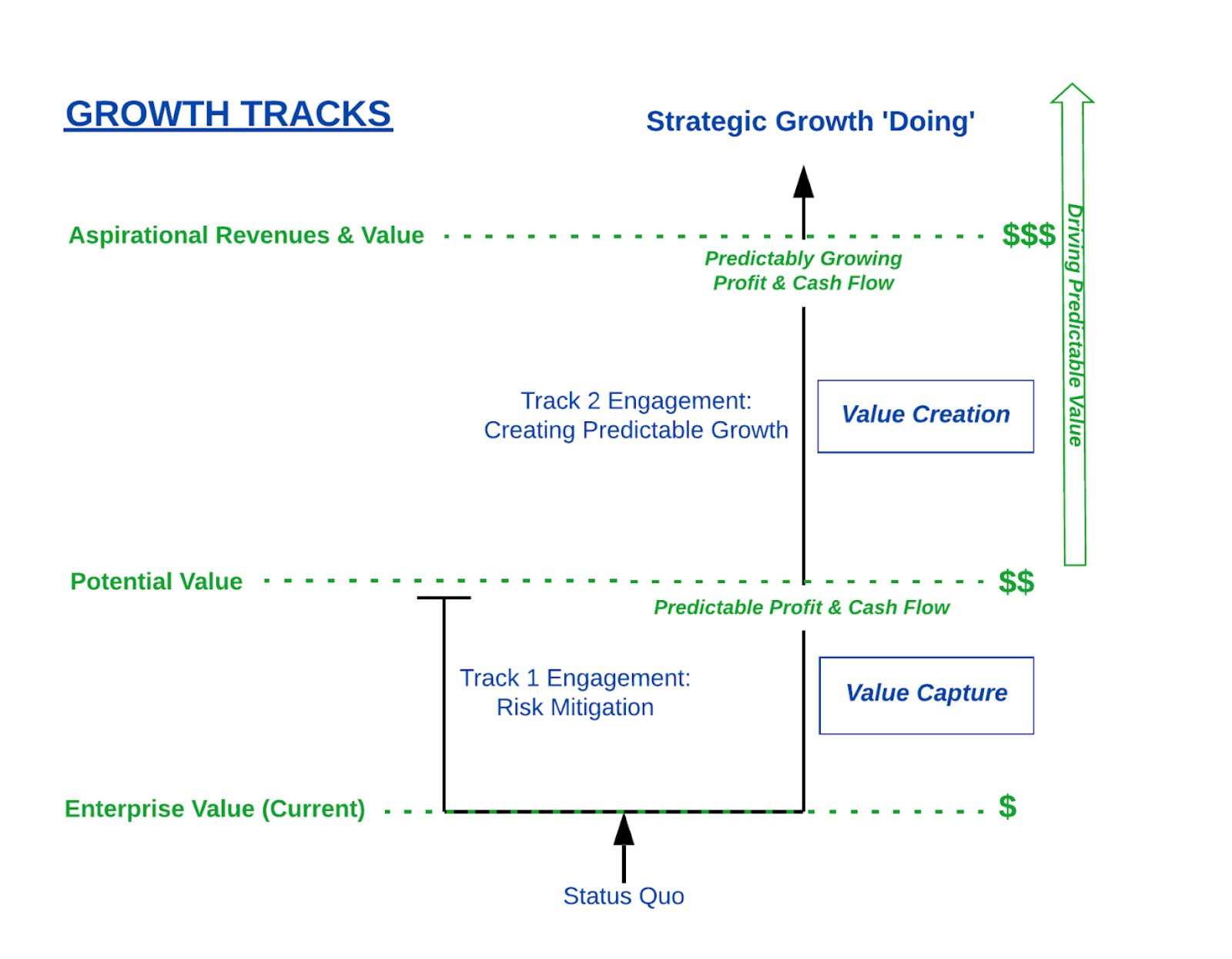

Cause-and-effect: high confidence in future performance neutralizes risk, thereby increasing equity value. (1) Predictable Profits and Cash Flow and (2) Predictable Growth are key to creating Predictable Value which is the ultimate measure of business success. The first captures value; the second creates value.

Let's recap. Here are the elements of the growth and equity value-driving areas from Dimension 1. Having a high score in all 8 growth drivers means you can be highly confident that you are creating the launchpad for phase 2: Predictable Growth

Creating Predictable Growth

What rocket stages will you launch from the pad? The Second Dimension of Growth is Predictable Growth- aka growing without chaos. There are two growth tracks.

The first track is simple ‘Value Capture’ through risk mitigation. You are not growing the value of the business per se, you are simply helping your client capture latent value (the value that cannot be monetized due to company specific risks). You are not creating net-new value by growing profits and cash flow.

In ‘Value Capture’ engagements you are helping your client increase their CoreValue Rating, aka Confidence Index. This is accomplished by boiling risk out of the business… Voila, you’ve captured value - but you are not yet driving growth. On this track, equity value is limited to whatever the top end of the industry’s normalized trading range.

You're probably wondering “What if my client is in the 74.77% who have aspirational revenue and equity value goals? How do I help them?”

Delivering Aspirational Revenues and Value

This is where the Value Creation lives. Let's start by looking at a company that has created a launchpad of Predictable Profits and Cash Flow (which btw also drives higher equity value and makes the company easier to run).[1]

Where your client has aspirational revenue and value goals, or if they simply want to grow the business because they're having fun, then we need to create an engine where you can pour marketing leads into the hopper and predictably get cash out of the other end.

Where your client has aspirational revenue and value goals, or if they simply want to grow the business because they're having fun, then we need to create an engine where you can pour marketing leads into the hopper and predictably get cash out of the other end.

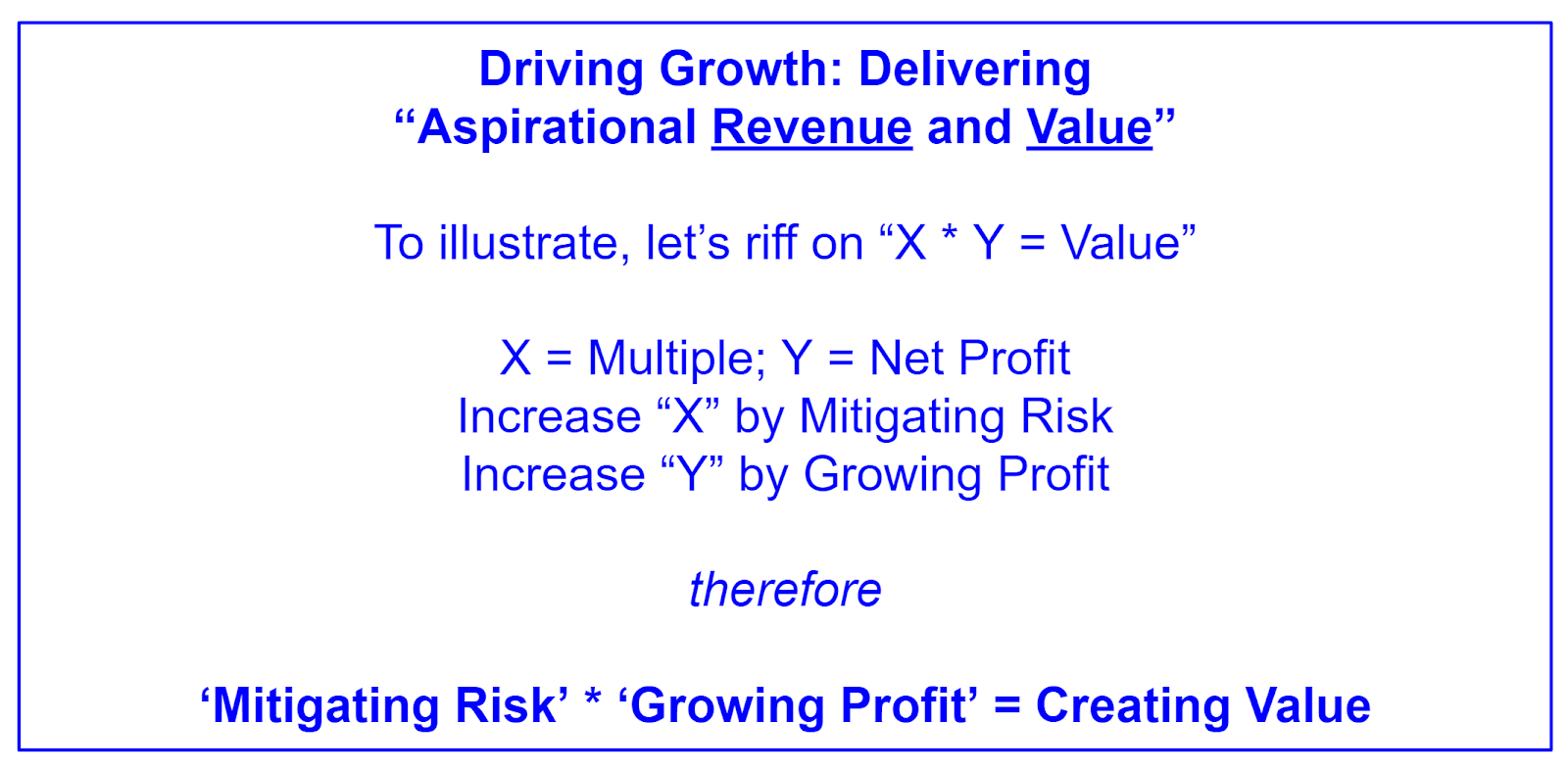

Equity Value is a result, and the growing-cash-flow / equity-value connection is clear. Creating predictable profits and cash flow increases the multiple of EBITDA applied to calculate value. We then need to look at the multiplicand (EBITDA), ensuring that the number is large enough that the product of the equation is a sum sufficient to meet your client’s goals.

As we've said many times, we need to plan growth within the constraints of cash flow. If the rate of growth outpaces the company's organic cash, then we need to plan to take on debt, or to bring in an equity partner.

Let's keep things simple. Your client wants to double net income in 5 years, meaning they will need to grow 15% annually. Leveraging the growth launchpad we created in the first phase of your engagement you now can harness predictability to confidently forecast cash flow, which will in turn fund Value Creation - Predictable Growth.

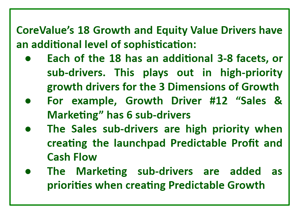

Here are the Growth and Equity Value Drivers requiring high confidence in the second dimension: Predictable Growth.

- Strategic Direction: You have a strategic plan that supports the owner's personal goals. This

plan includes a vision and mission, business model, business goals, objectives, and an executable plan (tactics).

plan includes a vision and mission, business model, business goals, objectives, and an executable plan (tactics). - Market Size: The market supports significant growth of the business.

- Product Differentiation: Your company has a product/service with unique characteristics that provide a competitive advantage.

- Brand: Your company has a recognizable brand that reinforces the business' presence in the marketplace and supports the company's objectives.

- Customer Diversification: Your company has a well-diversified customer base.

- Marketing Plan and Process: You have a clear marketing plan and routinely engage in specific and organized actions to interest potential customers in your products or services.

- Budgets and Forecasting: You forecast both future revenue and future expenses, and compare actuals to your forecast.

- Recruitment and Performance: You have a process to identify, screen, and select new employees; You set quantifiable objectives for employees; You have a process to manage employee performance including creating objectives, sharing objectives with employees, evaluating performance against objectives, and revising objectives as necessary.

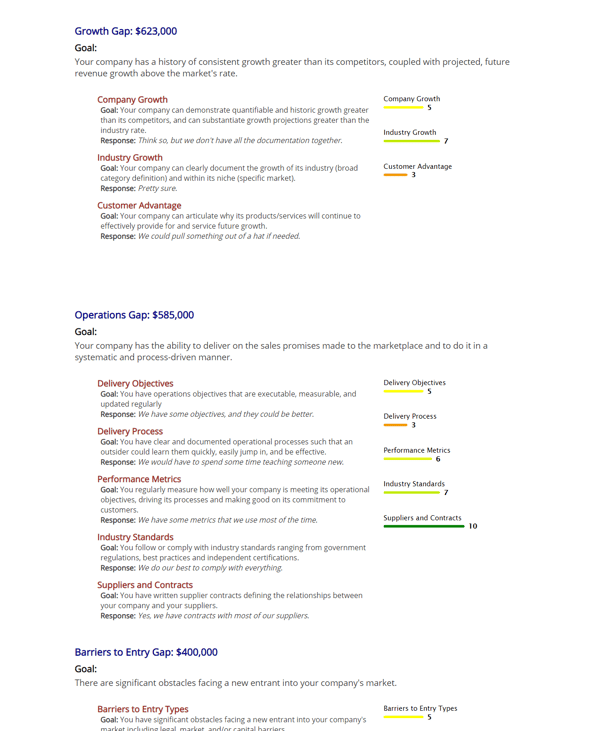

Sample Analysis Graphic, showing 'Growth', 'Operations' and 'Barriers to Entry' as bottlenecks to Growth & Equity Value:

©2011-2020 CoreValue®

Growth Consulting has two objectives in this phase:

- Maintain confidence in Predictable Profit and Cash Flow (funds growth), and

- Execute on a timeline to increase strength in any/all weak ‘2nd Dimension’ Growth and Equity Value Drivers, driving them to a ~7 score (70% or higher Confidence)

It starts with analyzing the totality of your client’s operations, and demonstrating that you understand how to make their aspirational revenues and value actionable. You be creating the right strategic growth plan, and then serving as the CEO's peer converting the plan into reality. After all, how much fun is a map if you don't use it to take a trip? You're not just a strategic planner, you're a strategic doer. We’ll show you how.

[1] A company that has the First Dimension well in hand should, barring Red Flag threats, be able to monetize successfully.