Tax and Audit services have been under siege for several years. Valuation services face headwinds, including a market shift from CPA firms to Management Consulting firms. Management Services have industry-leading growth --but how do you start or scale a business consulting practice?

The world is evolving --should you do anything about it?

The short answer: “Yes --adapt and win.” You can develop what an industry guru calls "Tier 5 Services," with "Premium Pricing, High Profitability, Recurring Fees, and Low Risk & Stress."

Do you want to know what “Tier 5 Services” are? I’ll bet you do!

We're going to talk a bit about the valuation industry. Formal valuations are a vital service --and while some businesses will need a formal, standards-based valuation this year, ALL businesses will be looking to grow. Second, professional organizations like NACVA are ahead of the curve, helping their pros compete in a class above. OK, back to the story.

Our friend Ron Everett is a Certified Business Appraiser (CBA) and Certified Valuation Analyst (CVA). He is co-founder and managing partner of the Business Valuation Center. Ron and his partner Ray Ghelardi, who is an Accredited Senior Appraiser (ASA) and former Managing Director at BDO, have just authored “Special Report: The Current State of the Business Valuation Industry.”©BVC 2017

The Special Report was created because a 2016 IBISWorld report on the valuation industry shows an alarming picture – valuation is an industry in severe decline with projected negative growth forecasted out to 2021 at -3.6% per year (CAGR).

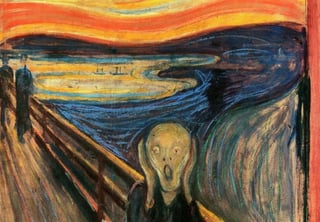

By now many of us are freaking out.

Spoiler alert: by looking beyond the numbers, Ron came to a powerful conclusion.

Ron dug into the data and found that astute practitioners can actually increase revenues by adding what Ron calls “Tier 5 Services:”

· Corporate Strategy· Value Growth· M&A Planning

From the Special Report:

“We began realizing that the valuation industry [...] is shifting quite rapidly from the traditional low-priced commodity service that we all know and love (and feel really comfortable producing) to a high-growth, high-margin service, provided by other competing industries, who are re-purposing and re-packaging the basic knowledge and know-how that goes into a typical business valuation report into a higher-priced and higher-demand service. And they are successfully selling a far more useful service to a far bigger and better set of clients willing to pay a premium price on a recurring or continuous basis.” Special Report, page 12-13.

My take on what Ron is saying? (1) Professionals who keep doing the same-same face stagnation. (2) When company value is actionable, it can be the linchpin for high revenue engagements. Value becomes actionable when you measure its drivers, identify bottlenecks, and deliver a strategic plan for clients to break through bottlenecks using your services. If you could make your valuations actionable, you'd get more value growth engagements, right?

Did you know that the average company has a value growth opportunity of 27% --and the data is in, that a firm applying best practices can grow client GR 21.63% annually? Wowzer! I mean hello, would your clients love you if you could deliver that kind of growth? They would, wouldn’t they? You bet.

So do you want to learn about the tools and training you need to get started?

Here are some next steps:

1. Read Ron’s Special Report in full here, and check out his web page,

2. Sign up for NACVA's 'Build a Thriving Practice' training (worth 10 hours of NASBA CPE, and can be included for free with your license),

3. Add the #1 business consulting system to your practice that will help you deliver these high impact services.

Want to learn more? Schedule a consultation to learn how using CoreValue can help your practice thrive.

Let us know what you think: post a comment, or email gsandmann@corevaluesoftware.com.