After launching the 3 Dimensions of Business Growth, we realized that you’d benefit from answers to two questions:

- Why do you need the 3 Dimensions of Business Growth?

- Exactly what is it?

Let’s answer these two questions, and in the next article we'll explore the Third Dimension: creating Predictable Equity Value.

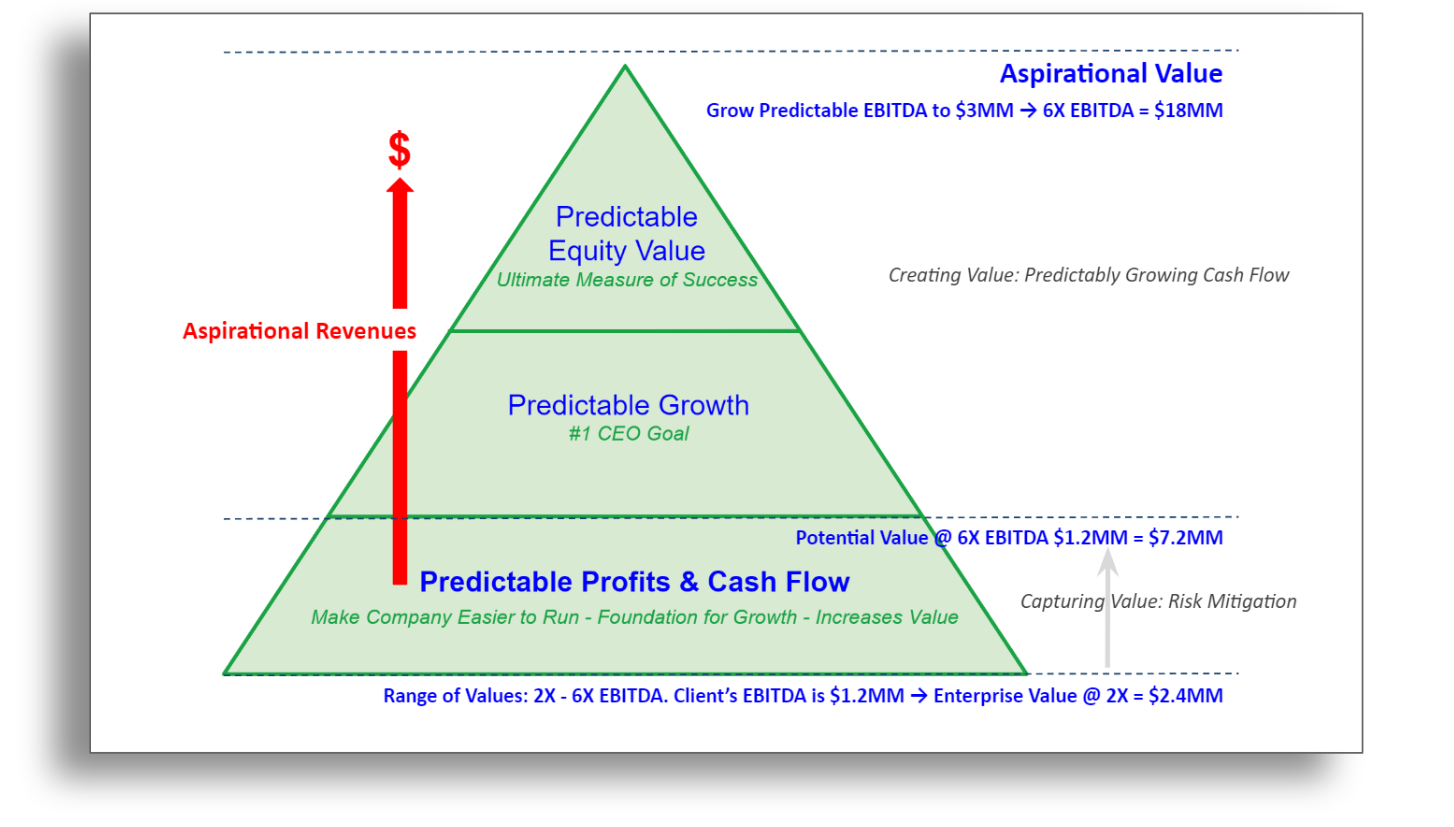

The 3 Dimensions of Business Growth™ for driving client engagements from their status quo to aspirational revenues, equity value, and operational excellence.

The 3 Dimensions of Business Growth™ for driving client engagements from their status quo to aspirational revenues, equity value, and operational excellence.

Why did Drive Growth LLC develop the 3 Dimensions of Growth methodology?

From analysis of over 25,000 companies we know there are three top CEO goals:

- Growth: 59% of CEOs want to increase profits and cash flow

- Operational Excellence: 22% of CEOs want to make their company easier to run

- Prepare for Sale: 17% of CEOs want to maximize/prepare to monetize equity value

The CoreValue Software itself does an awesome job guiding equity value maximization, which is the ultimate measure of business success. However since only approximately 20% of CEOs want to maximize equity value today, we needed an additional overlay on the CoreValue analysis that would help advisors deliver planning and consulting engagements growing profits and cash flow, and making companies easier to run.

The 3 Dimensions of Growth guides your consulting engagements by helping you set priorities aligned with one or both of these dominant strategic goals. And, oh-by-the-way, all the while creating and capturing equity value.

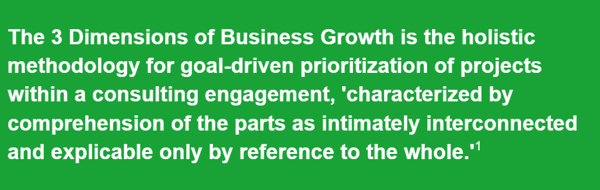

As for defining the 3 Dimensions methodology, let's hammer it down:

There's a lot going on there, so let’s unpack:

“Prioritization of projects” = strengthening growth and equity value drivers based on their direct relevance to the strategic goal

“Strategic goal” = a clearly defined successful end-state, for example “By December 2021 the business will sustainably grow EBITDA to $1.8MM, with gross and net margin above industry norms.”

"Comprehension of the parts" = understanding the strength, and relative priority, of each Growth and Equity Value Driver in the context of the strategic goal

"Intimately interconnected" = growth and equity value drivers are connected gears in the business engine, and action taken on individual drivers affects the entire business engine

"Explicable only by reference to the whole" = growth and equity value are outputs of the whole business engine

Stay with me: by measuring the strength of the gears in your client's business engine, and applying resources to prioritized drivers based on your client's goals, your consulting engagements can efficiently move clients in 3 dimensions, creating:

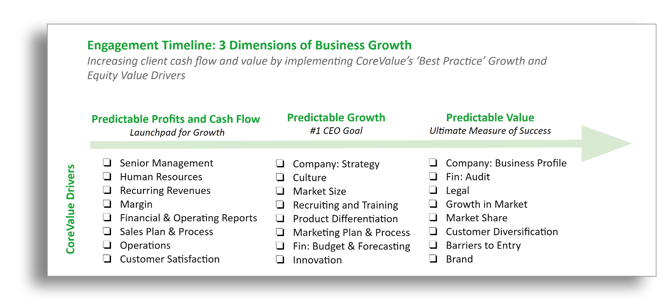

- Predictable Profits and Cash Flow, thereby making the company easier to run; creating a launchpad for growth; and capturing latent equity value

- Predictable Growth, through which you'll increase cash flow in a manner that drives net-new equity value

- Predictable Value, by mitigating risks thereby creating high transaction confidence for M&A (monetization)

Link: First Dimension, creating Predictable Profits and Cash Flow

Link: Second Dimension, creating Predictable Growth

Plans start at "Free": get CoreValue Starter

Next week: The Third Dimension of Business Growth, 'Predictable Equity Value'

[1] Oxford Dictionary https://www.lexico.com/en/definition/holistic