Here’s the thing: company value is important, but it’s hard to sell value/valuation services because clients don’t know why they’d buy. Clients just don't care unless they’re under the gun: M&A prep. Partnership dissolution. Buy/Sell Agreements. Divorce. The IRS. It's a small % of engagements. Are you wondering why selling ‘value growth’ doesn’t resonate?

“I already know what my company’s worth.” “I’ll take care of that later.” “I’ll work for a while, then sell the company for what I need to retire.” Sound familiar? You're not alone. We hear these reactions all the time from pros like you trying to get the CEO’s attention.

“I already know what my company’s worth.” “I’ll take care of that later.” “I’ll work for a while, then sell the company for what I need to retire.” Sound familiar? You're not alone. We hear these reactions all the time from pros like you trying to get the CEO’s attention.

jump to upcoming events jump to the next webinars jump to demo request

Do you want to know what clients DO care about? Growth. Revenue growth. Growing faster than their peers. Planned, consistent, predictable growth. I mean, everyone wants growth, right? Heck, isn't this exactly what you want for your own firm?

Brings us to a terrific question that Dan emailed yesterday, To summarize:

“George, you said CoreValue has a proven track record of increasing GR by an average of 21.63% annually. But the software is all about increasing the value of the company, the tasks are about increasing the value. The value gaps show the dollar amount by which the value would increase, not revenues. And quite frankly, in the tasks and recommendations, I do not see any concrete and specific recommendations that show how to increase sales.”

BINGO! This is all true Dan. So how do you use this analysis to grow revenues?

CoreValue is based on measuring operational strength and calculating how strength impacts the business’ place in the range of value. For example, and this is hypothetical, a company corevalue-rated 62 of 100 could get 2.7X EBITDA from the capital markets.

Markets prepay tomorrow’s growth based on confidence in future performance. Think of confidence as the 2.7X applied to today’s numbers. Now, how do you help your client create confidence? By demonstrating a track record of consistently and predictably growing revenues --connected to a strategic plan that, when executed, will keep them growing...

...And how do you consistently and predictably grow revenues, and sell this performance as the future for a subsequent owner? Documented, successful, replicable, scalable process. Process drives growth; growth drives value. CoreValue software measures the strength of internal processes. Increase strength, break through bottlenecks, grow.

OK, let’s bring it home.

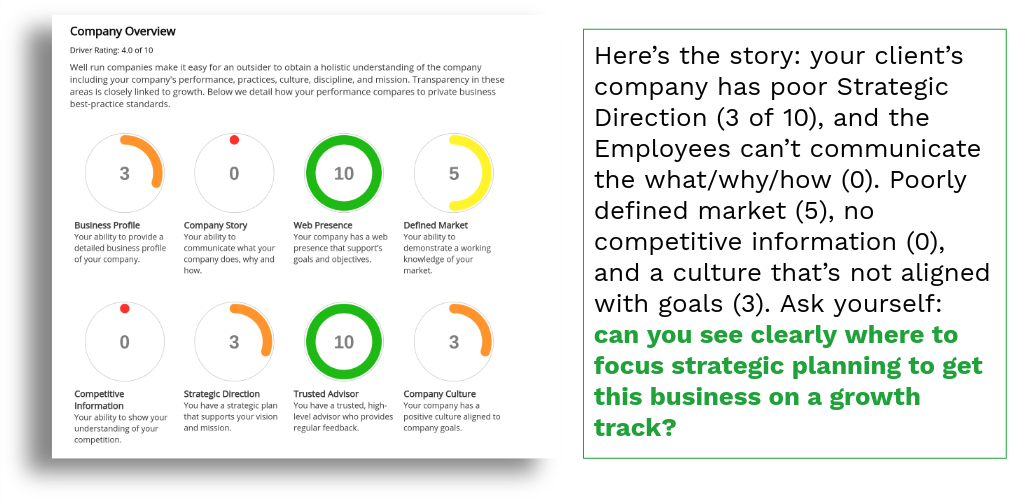

The story line: Your client hires you to prep a strategic growth plan. What operational areas will you hit? Your client’s people must all understand the company’s strategic goal. These people need to execute a business process, with accountability to the goal. Growth comes from net new sales: marketing needs to generate consistent quality leads; sales must consistently convert them into paying customers. Ops must deliver on the promises made to the market by sales, and finance must deliver the data needed for the CEO to keep her finger on the company’s pulse real-time. You, their Growth Consultant, need to understand the strengths and weaknesses of each these areas, delivering a plan to strengthen weak growth drivers. The CoreValue Deep-Dive Analysis and Executable Growth Plan delivers.

As Dan accurately points out, the software focuses on each area’s contribution to enterprise value. This is where the training in your growth-driving business consulting system proves its worth. You’ll learn to prioritize these growth drivers:

- Company Overview --Strategy, aka a plan to reach a well-defined goal; and company story --all employees understanding where the company is going and their role in getting there. Growth Drivers 10:6 and 2

- Human Resources --clearly defined roles and responsibilities, with metric-driven accountability. Verne Harnish’s “the right people doing the right things right.” Growth Driver 16:1

- Sales & Marketing --creating sales and marketing processes managed using clear performance metrics. Growth Driver 12

- Operations, the ability of the company to deliver on sales promises. Growth Driver 13:1 and 3

- Financial: operating reports to keep a finger on the company's pulse, plus timely and accurate reports on cash, p&l and balance sheet. Growth Drivers 11:2 and 3

To answer Dan’s original question, the complete growth-driving business consulting system unpacks the value drivers and trains you how to prioritize for the whole spectrum of strategic goals, including growth planning. This is far beyond mere value growth, allowing you to reliably help your clients meet the totality of strategic goals. So while your work may increase value, your client's "why?" is growing revenues.

Our customers look to us for a complete consulting system, leveraging the best methodology to drive results across the entire spectrum of strategic goals --not just value. Glad to demo the business consulting system, simply click here.

We are bringing the new Growth & Equity Planning Curriculum to market, the beta was presented at the annual Growth Consulting Conference. We'll build on it at the May conference. Want more info? Take 2 seconds to fill out the contact form to the right and we’ll give you a call.

PS: Short answer re the 21.63%. We can't pull a number for the d-base as a whole, because buying CoreValue software is like buying a gym membership. If you go with a trainer and use the equipment, you’ll get results. The software alone, like the membership, won’t do it. This was a third party program of companies with ~$10MM average GR run under the aegis of the DOD and State of Virginia. The program companies “went to the gym.” They had an executable growth plan built on CoreValue, and business consultants holding them accountable to executing the plan. When these companies strengthened their weak growth drivers, revenues increased an average 43.26% at the end of program year 2. Think about what this would do for your clients --and for your practice.

If you can't get the CEO's attention talking about value and valuation, try talking about growth. We'd be happy to train you how.

We'd love to know what you think, please comment here or email blog@corevalueforadvisors.com.

Upcoming Events:

The beta Growth Planning class is full! Thanks to each of you who signed up at the conference. If you want 'on' the list for the next class, please email gsandmann@corevalueforadvisors.com

Spring Growth Consulting Conference April 29-May 1, Orlando --info and register here. All are welcome to this Master Session focusing on consulting innovation. This year we'll unpack and discuss the Growth Planning curriculum --your chance to learn, and add your expertise to the discussion.

Free Webinars:

- Dec 2: Strategic Planning using CoreValue Deep-Dive Analysis

- Dec 10: Marketing Tactics for Business Advisors

- Dec 12: CoreValue's Proven Process to Win New Engagements