Dan’s whole question:

“You mention operating reports under Financial. I noticed the software many times recommends operating reports. I am a CPA and I've done business valuations for 20 years. I never received operating reports. I never even heard that term. What are operating reports?”

And here, ladies and gentlemen, we get to the crux. THE ONE THING. If you can guide your client through creating Operating Reports for their high priority ‘Growth and Equity Value Drivers™’ (aka Growth Drivers) you’ll magically have the fodder for a dashboard, a finger on the pulse, a steering wheel for the business.

jump to upcoming events jump to the next webinars jump to demo request

Sounds exciting, doesn’t it? It is. And it’s easy --we’ll show you how.

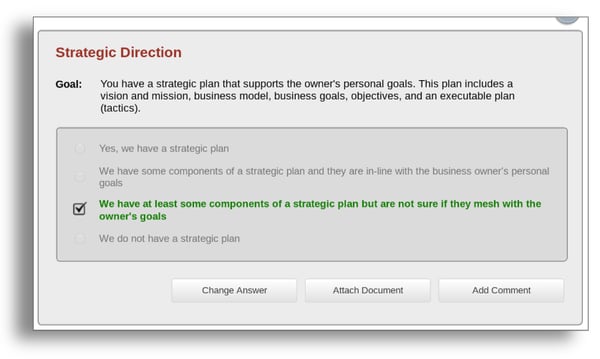

You and your client have identified their strategic goal, and CEO wants to grow. In “Selling Value/Valuations? CEOs Don’t Hear You” we looked at the top 5 (of 18) high priority Growth Drivers: if your client wants to grow, they absolutely need

- Strategy: where are we going, what’s our plan to get there

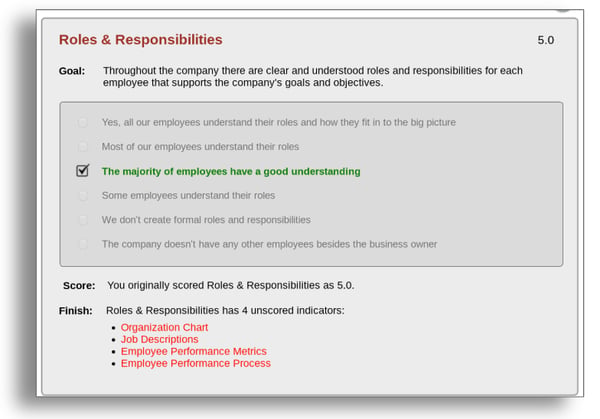

- People: who’s executing what part of the plan, with accountability

- Sales & Marketing: the right people executing the right process drives scale

- Operations: quality delivery of sales’ promises to customers

- Financial: control the numbers or they’ll control you

Operating Reports are organized in Growth Driver ‘Financial’ 11:3. Why in Financial, if “Operating Reports’ at first blush seem to belong in COO-land?

Because Operating Reports connect the budget to operations. Operating Reports are the CFO’s purview, working in collaboration with the COO. The COO may be responsible for gathering the data, but it’s the CFO who must connect this data to the company’s cash lifeblood, which funds all work towards the business’ strategic goal.

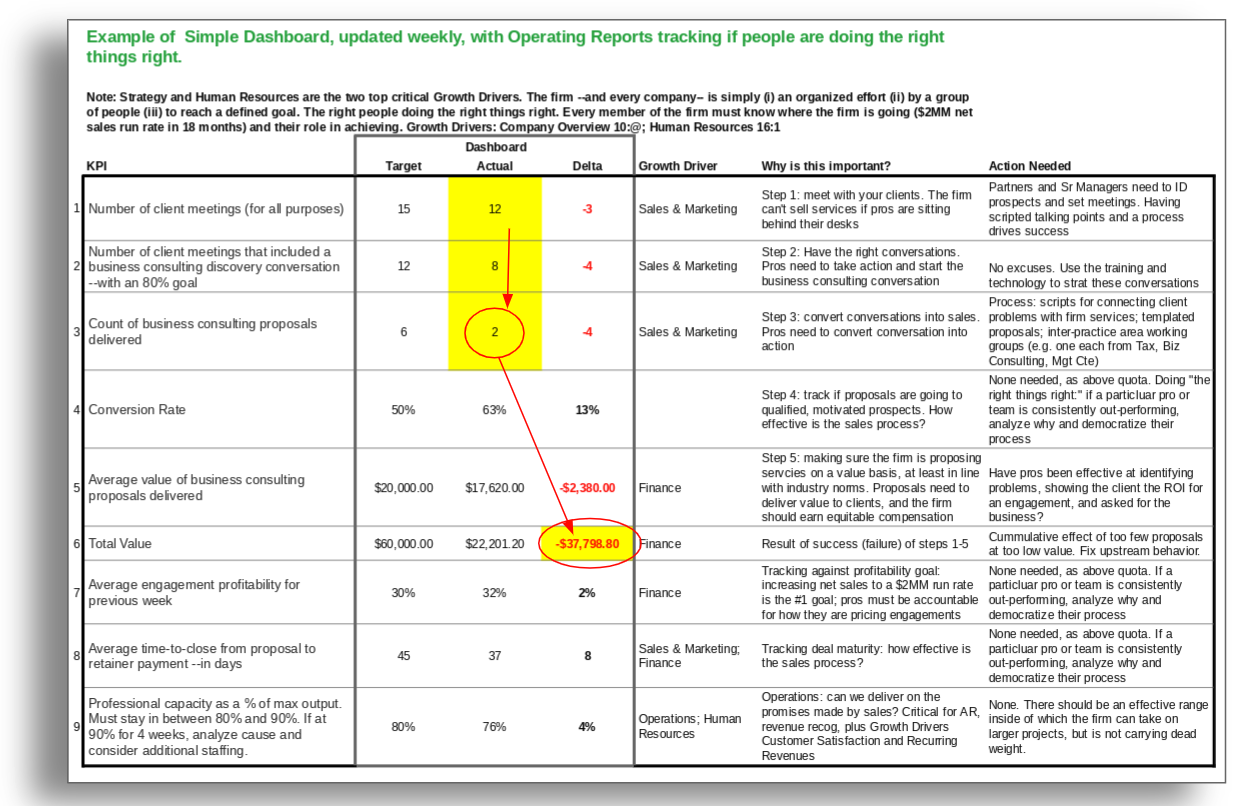

Let’s look at our Toplift Services PLLC case. As you’ll recall, CEO Elizabeth Smith has identified a strong commitment to growth --of both gross revenues and profit. Operating Reports track the activities that will generate these results. What would you help her monitor? What metrics must be on her dashboard? How do we connect behavior and daily process to results? The firm needs to make sure the right people (HR) are doing the right things (Process) right (Results). Operating Reports measure the second and third “right” tracking the results from process execution.

To reach its goal the firm needs to expand services to existing clients, and to win new clients. They also need new engagements to be priced such that clients are getting high value and the firm is being paid equitably for the results they're driving. In a growth engagement, the client should get a 10X-20X return on their professional services investment.

Here are a couple of examples of the operating data your client Elizabeth will want to track weekly. Like many firms, Toplift is evolving from “Accountants and Advisors” to “Advisors and Accountants.” Focusing on existing clients, the firm needs to make clients aware that there is a wide array of services available beyond traditional tax and audit. ‘Tax Season’ is here, and the firm’s pros are going to meet with all of the firm’s most important clients. What a great opportunity to "do right things right."

Let’s spitball a dashboard where your client puts the CoreValue ‘Discover’ initial assessment of company strength and value into the many hands of firm pros going out on client meetings, with the goal of building a pipeline of financial and management consulting opportunities. What metrics should be tracked weekly making sure Elizabeth and Senior Management have their finger on the pulse --that they know, before it's too late, that the pros are doing the right things for the firm to reach its growth goal?

They’ll need to track people, process, and connect these to results. This example is simple --and simple is great. In a perfect world each pro is accountable to one strategic number; don't be fooled into using client billings as the metric. Why? By the time a proposal's been accepted, work has begun, invoices submitted, and your client's AP cycle's run, it's months later, and too late to make the needed adjustments. In this example, we want pros meeting with clients and running an initial analysis of company strength and value. How many? Calculate backwards from the revenue goal, then pad the number.

If your average engagement generates $20,000, and the goal is $2MM, you need 100 engagements. Let's overshoot by 20%: 120 engagements. The firm converts 50% of proposals into engagements (240), and delivers proposals after 50% of bona fide discovery meetings (480). You project that 80% of clients can spare 10 minutes to receive a valuable report about operational strength and value. (600). What is the one number needed on a weekly basis? A good candidate for 'One Number' is the count of discovery meetings where the firm pros start the business consulting conversation: 12 a week; pad to 15. If the follow-up process is sound and pros are accountable at each step, Elizabeth will know from her Monday morning Operating Reports if future revenue is on target. Now she's on the path to predicting revenue.

How does this report guide behavior? Here’s what this operating report is telling you: “We’re going to miss our revenue target because we don’t have enough revenue in the proposals that will close in the next 6 weeks. Why? Because of the 15 clients we should have met last week, we only met with 12; and of these, we only started the business consulting conversation with 8 and only delivered 2 proposals of a target 6 (33% of goal). The proposals will not deliver our target Rev Per Engagement. We’re ($38,000) against goal for the week; an annualized rate of ($1.97MM).” A small miss --3 meetings too few-- coupled with a the other small misses cascade into a ($2MM) hole. Unless you’re constantly tracking this data, you won’t know you're sunk until the month is a distant object in the rear-view mirror.

As Elizabeth's Growth Consultant you can clearly see the need to coach client-facing pros about their individual role in meeting firm goals, and hold them accountable: Growth Driver 12:4 ‘Sales & Marketing:Sales Plan and Process.’

Some examples of the Growth and Equity Value Driver ‘Private Business Standards’ (best practices) that have a proven track record of growing revenues and value -if the client is committed and takes action:

Strategy: have an executable plan to reach the shareholders’ goals

People: roles and responsibilities supporting the company’s goals

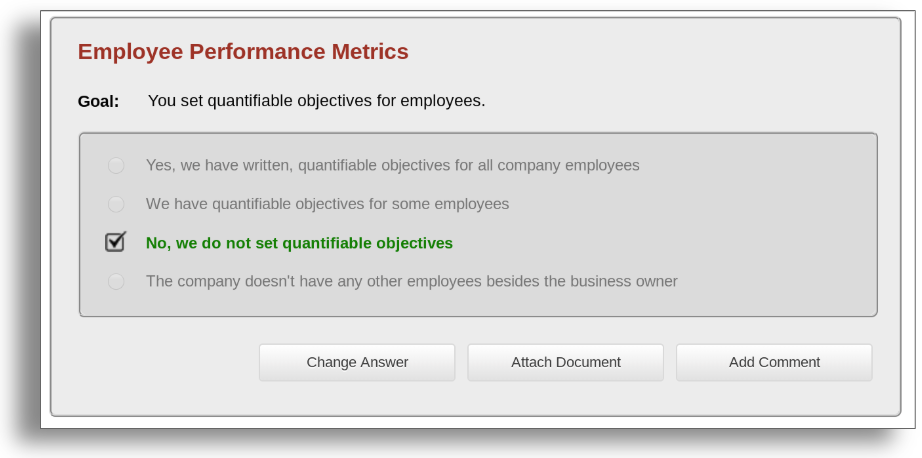

Performance: quantifiable objectives --and performance against these objectives is captured in the various operating reports

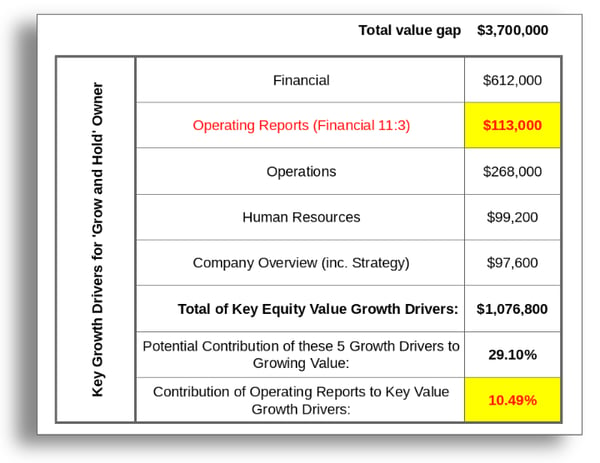

Does the market value Operating Reports? “Highly.” For Toplift PLLC, the 5 Growth and Equity Value Drivers that are High Priority for growth contribute 30% of the firm's total Value Gap --with Operating Reports comprising 10.5% of these 5 growth drivers. Weak Financial procedures contribute 17% of the total Value Gap (value that will not be paid in an M&A transaction), and Operating Reports are one fifth of Financial. Operating Reports are the linchpin to taking control --which is why the market rewards them so highly.

Conclusions:

- Operating Reports allow Management to monitor KPIs on a weekly basis, and take action in time to avert disaster

- Every employee should understand their 1 task --here, meeting with clients an running an initial analysis of company strength and value

- If your client’s goal is Growth, perform a Deep-Dive Analysis to identify weak processes. Get training to convert the analysis into a plan --and then win long-term engagements to guide clients as they turn plans into reality

- Always connect people activity to financial results!

We'd love to know what you think, please comment below or email blog@corevalueforadvisors.com. Post your questions, we use them as topics for articles like this one.

Upcoming Events:

The beta Growth Planning class is full! Thanks to each of you who signed up at the conference. If you want 'on' the list for the next class, please email gsandmann@corevalueforadvisors.com

Free Webinars:

- TODAY Nov 26: 'CPAs: Expanding Services and Client Retention using CoreValue"

- Dec 2: Strategic Planning using CoreValue Deep-Dive Analysis

- Dec 10: Marketing Tactics for Business Advisors

- Dec 12: CoreValue's Proven Process to Win New Engagements

'Growth and Equity Value Drivers' ©2019 Consulting Software System LLC